Sardinia surveys and stock assessments to aid strategies

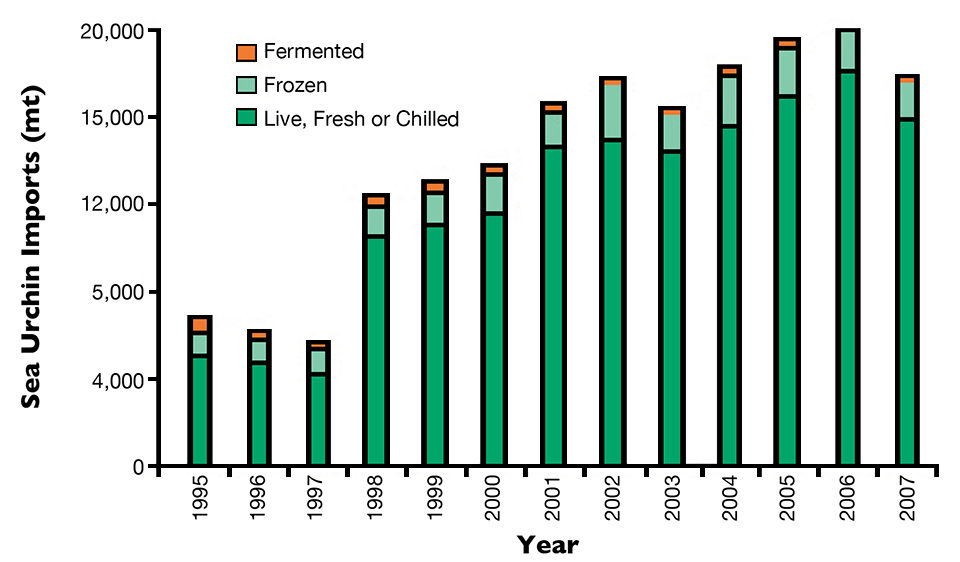

In many parts of the world, populations of sea urchins are declining. However, imports of sea urchin products by Japan have been on a general increase for the last 10 years or more (Fig. 1). It is unlikely that future market demand for sea urchins will diminish, and as a result, it is predicted that aquaculture will be required to fill this potential gap between supply and demand. Concomitantly, the amount of research on sea urchin aquaculture has increased dramatically in the last decade and a half.

In contrast with importation data and research efforts, world fishery production of sea urchins has dramatically declined over the last 15 years from 115,000 to about 82,000 metric tons (MT). These numbers clearly reflect the overexploitation of most fishery grounds and highlight the need for conservation policies, fishery management and aquaculture development.

Aquaculture interest

Over the past 10 to 15 years, commercial interest in rearing echinoids has increased in a number of countries, including Japan, Australia, Canada, Chile, China, New Zealand, Norway, Ireland, Italy and Scotland. In all these countries, initial research efforts and later commercial interest have been supported by the discrepancy between demand for fresh sea urchin gonads and supply from fisheries.

In each area, the shortage in supply was always led by a depletion of local wild stocks. As a consequence, actions have been undertaken to enhance sea urchin fisheries or commercial production.

In Japan, seeding hatchery-raised juveniles into the wild enhances the sea urchin fishery. In New Zealand, research is focusing on roe enhancement and some work on the culture and development of larvae and juveniles. In Australia, sea urchins are commercially harvested, and the only aquaculture research has been on post-harvest roe enhancement.

Sea urchin research is very active in Norway, where Bodø University College is pursuing a strategy of full domestication, with the explicit goal of bringing the entire production cycle of the sea urchin under a controlled industrial regime. The Norwegian Institute of Fisheries and Aquaculture Research is developing techniques for gonad enhancement of wild urchins using formulated feed.

As opposed to many other countries, Scotland has focused its research efforts on designing and promoting integrated multitrophic aquaculture systems featuring sea urchins and seaweed alongside Atlantic salmon operations. Extensive research has recently taken place at Scotland’s Ardtoe Marine Laboratory, Scottish Association for Marine Science, and Institute of Aquaculture of the University of Stirling to develop new commercial hatchery operations. The more generalized European ENRICH Project funded by the European Community is evaluating means and strategies to further expand integrated multitrophic aquaculture involving sea urchins.

The species most often targeted for aquaculture development projects in Europe is Paracentrotus lividus, the purple sea urchin. Yet the wide development of a major commercial urchin-farming industry has been restrained by the lack of a fully developed technology for the cost-effective production of sea urchins with the desired gonad quality.

Major consumers

The global trade in sea urchins is a lucrative business. Nonetheless, sea urchins produced by aquaculture presently account for less than 1 percent of the approximately 80,000 mt of urchins sold every year worldwide.

Japan is considered the main sea urchin consumer country, based on its annual importation of 20,000 MT and local production of 15,000 MT for its 130 million citizens. Sea urchin consumption there averages 0.27 kg/person. Chile is generally considered the major producer. The country harvests 55,000 MT of live urchins from over 78,563 km of Pacific coastal line.

Sardinia

Sardinia, the second-largest island in the Mediterranean Sea, is an autonomous region of Italy. Sardinians consume more sea urchins than the Japanese and harvest the sea harder than anyone. The 1,849 km of Sardinian coastline is generally high and rocky, with long, straight stretches of coastline; many outstanding headlands; a few wide, deep bays; many inlets and various smaller islands off the coast.

Sea urchins are widely consumed in Sardinia as traditional food. Recent surveys recorded that about 30 million urchins (1,800 MT) are consumed every year, providing a turnover of more than €10 million ($13.2 million). With 1.7 million inhabitants, Sardinia’s annual per-capita consumption is about 1.1 kg –about four times the Japanese consumption.

The sea urchin harvest from fisheries in Sardinia averages 0.9 MT/km coastline – 0.2 MT more than Chile. The sea urchin fishery is putting immense pressure on wild stocks of P. lividus, and it is easy to understand why natural stocks are depleted and more than 50 percent of harvested individuals were below minimum size last year.

Better management

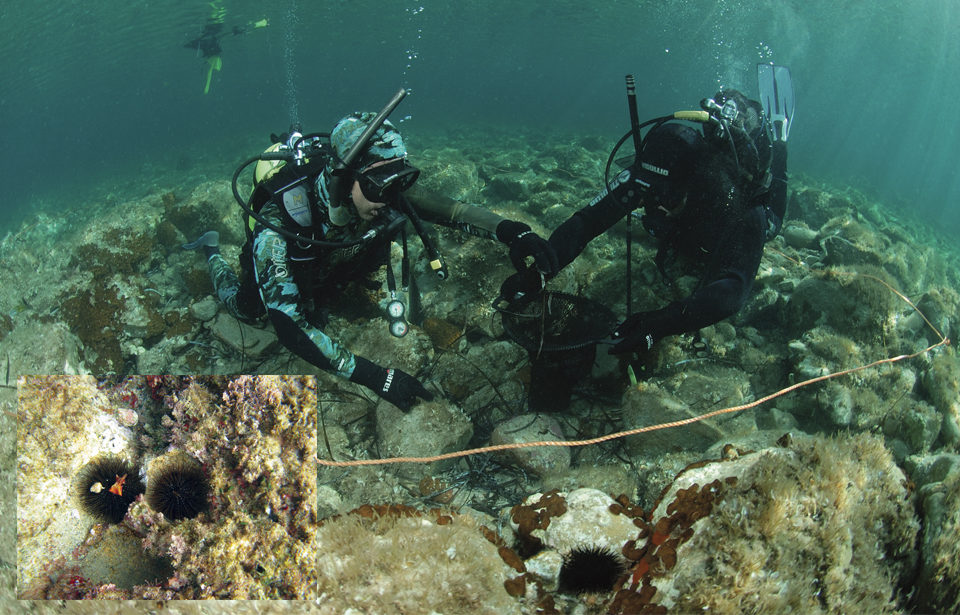

Local universities supported by the local government have recently undertaken thorough environmental surveys and stock assessments in Sardinia to define best management practices and strategies to sustain the lucrative sea urchin business without compromising its long-term sustainability.

A project funded by the Sardinian region is focusing on the species ecology, biology, nutrition and reproduction with the intent of establishing the basis for an active restocking program sustained by a pilot-scale hatchery. Supported by international expertise, further development of aquaculture operations in the region will likely help fulfill internal demand, provide more sustainable income for the many fisher folk employed in the fishery and open up new business opportunities, as well.

(Editor’s Note: This article was originally published in the May/June 2012 print edition of the Global Aquaculture Advocate.)

Authors

-

S. Carboni

Institute of Aquaculture

University of Stirling

Stirling, Stirlingshire FK9 4LA United Kingdom -

P. Addis

Università di Cagliari

Dipartimento di Scienze della Vita e dell’Ambiente

Cagliari, Italy -

A. Cau

Università di Cagliari

Dipartimento di Scienze della Vita e dell’Ambiente

Cagliari, Italy -

T. Atack

Ardtoe Marine Laboratory

Acharacle, Argyll, Scotland

Tagged With

Related Posts

Responsibility

Can ranching ‘zombie urchins’ boost uni, save kelp forests?

With Norwegian knowledge and a partnership with Mitsubishi, Urchinomics aims to turn worthless empty urchins into valuable seafood while restoring kelp forests and creating jobs.

Aquafeeds

Aquaculture Exchange: Giovanni Turchini, Deakin University, part 1

One of the world’s leading fish nutrition experts talks about how aquaculture can learn to survive, and even thrive without depending on fishmeal and fish oil. It’ll take a lot of innovation, but Giovanni Turchini is confident that the industry is on the right path.

Innovation & Investment

Aquaculture in Canada: status, perspectives

Canada exports farmed seafood products to more than 22 countries and is the main seafood supplier to the U.S. market. Finfish, primarily salmon, production is strong and shellfish production is growing, but diversification will be imperative to maintain competitiveness.

Responsibility

Aquaculture gives endangered totoaba a fighting chance

The tenuous fate of a pint-sized porpoise, the critically endangered vaquita, is linked to a fish targeted by poachers fueling China’s appetite for maws. The vaquita remains in peril, but aquaculture presents some hope for the totoaba.