Switch leads to well-organized, fully integrated industry

The kingdom of Thailand is the world’s leading shrimp-farming nation. It exports the most shrimp in volume and value, and is the top supplier of farmed shrimp to the United States and Japan. Traditionally, the Thai shrimp industry farmed black tiger shrimp (Penaeus monodon) but since 2001, it has undergone a dramatic transformation and switched to Pacific white shrimp, P. vannamei.

Industry development

Thailand starting farming shrimp in the 1970s using locally available P. monodon broodstock captured from the sea to produce postlarvae in land-based hatcheries for pond stocking. By the early 1990s, Thailand emerged as the world’s leading farmed shrimp producer and exporter based on P. monodon production.

A combination of factors allowed Thai shrimp farming to develop into a well-organized, fully integrated industry. Technology is effectively applied at all levels in shrimp hatcheries, farms, feed companies, and processing plants, as well as international marketing companies. A diverse collection of entrepreneurial businesses and several multinational public companies create a competitive business climate that leads to innovation and increasing productivity.

Financing for the industry is substantial through several large publicly traded companies, as well as bank financing. Government support through the Department of Fisheries and university research programs support the industry through research and extension services.

Thai shrimp industry has a strong market focus with many processing and exporting companies to distribute Thai product worldwide. Thailand’s Mahachai shrimp auction provides an excellent outlet for independent farmers, who receive competitive auction prices for their shrimp. Daily auction prices are text-messaged industrywide. Several Thai companies have well-established marketing companies in the major import markets in the U.S., Japan, and Europe.

Disease issues

In the 1990s, disease problems increased risks and slowed industry expansion. Yellow Head and White Spot Syndrome Viruses severely impacted production, but government-sponsored research and extension helped the industry adjust and manage around the diseases. Despite such problems, the Thai industry maintained its position as top shrimp producer. In 2001, Thailand’s P. monodon production peaked at 280,000 metric tons (MT).

Since 2001, P. monodon farmers have faced a new disease called Monodon Slow Growth Syndrome (MSGS), which is characterized by slow growth that leads to small harvest sizes and lower prices. The cause of MSGS is still unknown. This slow growth problem with P. monodon set the stage for the introduction of specific pathogen-free (SPF) P. vannamei. Farmers were looking for a lower-risk, reliable way to make money farming shrimp.

SPF p. vannamei

Limited SPF P. vannamei broodstock imports were first tested in 2001. The impressive results showed high survival and fast growth to 20 g in 100 days with uniform distribution in two to three size classes at harvest. The SPF shrimp were tolerant of higher densities than P. monodon – up to 2.5 kg per square meter – and there were lower incidences of mass mortality. The industry lobbied to allow more broodstock imports in 2002. More farm trials followed, and 2002 also saw tests of “home-grown” F1 broodstock.

Farmers soon found that most of the growth and production advantages of true SPF P. vannamei were lost using postlarvae from the “home-grown” broodstock. Slower growth, large size variations, and more disease events were typically experienced with F1 stocks.

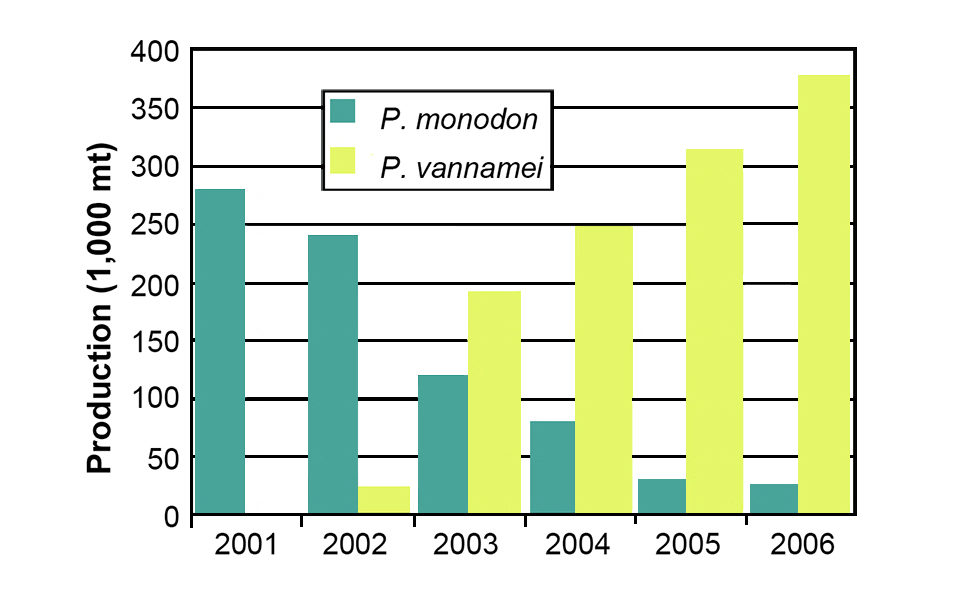

White shrimp production in 2002 jumped to nearly 20,000 MT. Fig. 1 illustrates the rapid 2002-2006 increase in P. vannamei production, while P. monodon production rapidly declined. In 2006, P. vannamei represented over 98 percent of Thailand’s total production entering the shrimp auction, and production is approaching 400,000 MT.

Current production

Progressive Thai farmers now produce 20 to 30 MT/ha/crop using SPF P. vannamei that are also resistant to Taura Syndrome Virus. Table 1 compares the relative production numbers and profits between species in Thai shrimp farms. These data clearly show the driving force of Thailand’s change from farming P. monodon to farming P. vannamei was the superior production economics with P. vannamei. Profits with P. vannamei are two to three times greater than with P. monodon. Production reliability through the avoidance of disease is also higher with SPF P. vannamei.

Wyban, Production parameters and profits, Table 1

| Parameter | P. monodon | P. vannamei |

|---|

Parameter | P. monodon | P. vannamei |

|---|---|---|

| Density (postlarvae/m2) | 40-50 | 120-200 |

| Crop duration (days) | 110-140 | 105-120 |

| Harvest size (g) | 22-28 | 21-25 |

| Yield (mt/ha/crop) | 8 | 24 |

| Crop value (U.S. $/ha) | $45,000 | $96,000 |

| Crop costs (U.S. $/ha) | $32,000 | $60,000 |

| Production profit (U.S. $/ha) | $13,000 | $36,000 |

Controlled broodstock imports

A key factor in Thailand’s success with P. vannamei is the country’s control of broodstock imports to ensure sufficient supplies of true SPF brood animals. A permit to supply broodstock is required from the Thai Department of Fisheries (DOF). Thai law requires that broodstock suppliers are certified SPF producers with a two-year history of SPF production and U.S. government certification. DOF Code of Conduct certification is required for Thai hatcheries to import SPF broodstock.

Ongoing trends

A recent trend in Thai P. vannamei farming is multicropping from high stocking densities of 200 per square meter that lead to a local supply of small (100 animals/kg) farmed shrimp. Industry consolidation is another trend, with large integrators testing a contract-farming business model.

(Editor’s Note: This article was originally published in the May/June 2007 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

-

Jim Wyban, Ph.D.

High Health Aquaculture Inc.

Hawaii Ocean Science & Technology Park

Kona, Hawaii 96740 USA

Tagged With

Related Posts

Health & Welfare

Alphavirus replicon particles potential method for WSSV vaccination of white shrimp

A study demonstrated that VP19 and VP28 white spot syndrome virus envelope proteins expressed by replicon particles provided protection against mortality due to WSSV in shrimp.

Health & Welfare

Ammonia addition enhances microbial flocs in nursery phase for Pacific white shrimp

In a study, “pre-fertilization” in the nursery phase of a biofloc system for shrimp was tested. The objective was to accelerate the biofloc formation to minimize ammonia concentrations, avoiding high peaks during culture.

Aquafeeds

A look at protease enzymes in crustacean nutrition

Food digestion involves digestive enzymes to break down polymeric macromolecules and facilitate nutrient absorption. Enzyme supplementation in aquafeeds is a major alternative to improve feed quality and nutrient digestibility, gut health, compensate digestive enzymes when needed, and may also improve immune responses.

Responsibility

A look at various intensive shrimp farming systems in Asia

The impact of diseases led some Asian shrimp farming countries to develop biofloc and recirculation aquaculture system (RAS) production technologies. Treating incoming water for culture operations and wastewater treatment are biosecurity measures for disease prevention and control.