Growing industry moves from live fish to value-added products

Red Lobster and Landry’s to mass merchandisers Wal-Mart and CostCo, tilapia have become almost as ubiquitous in the United States as salmon. Consumers in this major market now eat five times as much tilapia as trout. Each year, tilapia moves up another notch on the mostly commonly eaten seafood list. The U.S. consumed 133,140 metric tons (MT) of live weight tilapia in 2002 (Fig. 1).

Worldwide, tilapia are the third most commonly farmed fish after carp and salmonids, with global production of 1.49 million metric tons in 2002 (Fig. 2). As with carp and salmonids, the term “tilapia” refers to several closely related species and their hybrids – in this case, the genus Oreochromis.

Aquatic chicken

Tilapia has aptly been called the “aquatic chicken,” a description that has become more accurate as time goes by. Like chicken, there are no religious or social taboos about eating tilapia. Consumers have embraced the fish in every market where it has been introduced. It is now the most widely cultured fish on and off the planet. Tilapia eggs were hatched and the young animals reared on the international space station.

Tilapia are mild-tasting and nonoily, and do not have free bones in their fillets. Smaller fish are cooked whole in many countries. Most commonly, they are deep-fried or steamed, with any number of coatings and sauces. In the more developed markets, tilapia fillets are sold fresh or frozen in varying sizes.

Tilapia are known as “boulti” in Arab countries, “lou fei” in China, “pla nil” in Thailand, and “chambo” in East Africa. Many regions call tilapia St. Peter’s fish. It is widely believed that two tilapia species native to Israel were the target fish of the Apostles, and probably the fish Christ used to feed the multitudes in the miracle of the loaves and fishes described in the Bible. However, tilapia has rapidly become the common name of choice.

Environmentally correct

Because tilapia do not require fishmeal in their diets and most of the production systems used to date have minimal environmental impacts, tilapia have become the darling fish of the “greens.” To be honest, most commercial tilapia diets do contain small percentages of fishmeal and fish oil, because these ingredients improve growth rates and palatability, and probably also improve final flavor and omega-3 fatty acid content for consumers.

Some of the largest tilapia operations must be concerned about their effluent loads. But compared to almost every other fish farm operation, and certainly any land-based livestock, their environmental footprint is indeed small.

Development of international markets

The United States is the major international importer of tilapia products. Its market evolution is indicative of how the next major market, the European Union, is likely to develop.

In the late 1970s and early 1980s, several former Peace Corps volunteers returned to the U.S. and decided to put their experience growing tilapia to use at home. They were joined by a few catfish farmers who wanted to diversify their product lines. These early farms found their best customers were Asian immigrants who were familiar with tilapia and willing to pay a premium for live fish delivered to groceries and restaurants. Live fish still make up the major market for U.S. tilapia farmers.

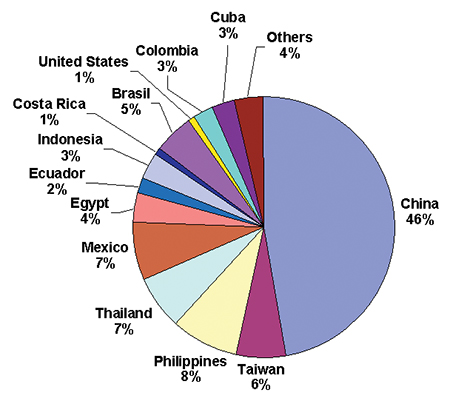

The next phase occurred around 1985, when Taiwanese exporters began to send large quantities of whole frozen tilapia to the Asian groceries that bought live fish, who then had a low-cost tilapia product to offer along with their live fish. Frozen Taiwanese fish still represent a significant share of imports, and have spread to low-cost groceries that cater to Latin American immigrants.

In the late 1980s and early 1990s, two new products appeared in U.S. tilapia markets: frozen fillets from Indonesia and fresh fillets from Jamaica, Costa Rica, and a few U.S. farms. These products were a huge success with virtually every market introduction. The U.S. farms quickly dropped out because they could not compete with the low-cost imports and the live markets were more lucrative.

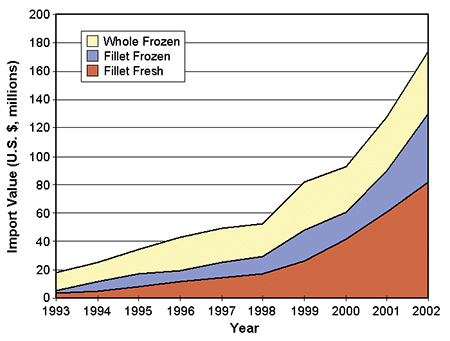

More fresh products flooded in from Ecuador, Colombia, and Honduras. Additional frozen fillets have come from Thailand, Taiwan, and China. The import value of this frozen and fresh tilapia comtinue to rise (Fig. 3).

U.S. domestic markets

The immigrant Asian markets have continued to expand with the growing immigrant population and their rapidly growing household wealth. These demographics have been critical to the U.S. live fish farmers. The less-affluent Asian and Latin American immigrants are major consumers of the low-cost whole frozen tilapia imports.

U.S. farmers looking for additional buyers outside the Asian restaurants led the market development. They began to market to up-scale “white tablecloth” restaurants, where chefs look for the best fresh fish products for their menus. These chefs appreciated the superior qualities of locally raised tilapia.

It could be delivered live or fresh on ice. It could be easily filleted by the restaurant staff. The tilapia was a mild fish that could be used to highlight the chefs’ skills with delicate seasonings and sauces. The high regard of professional chefs and tilapia’s appearance in top-quality restaurant facilitated its acceptance by the general public.

As demand grew, restaurant chefs began to look for less-expensive and more-consistent fresh fillets. The Latin American farms with brand names and high quality quickly filled the demand and have continued to grow at breakneck speed.

The rapid spread of casual dining restaurants and interest in seafood as a healthy alternative to meat have spurred the demand for tilapia products. Most recently, fresh and frozen tilapia fillets are flooding the club and bulk store chains. Packages of 1- and 2-kg fresh fillets and 2- to 4-kg packages of frozen fillets sell for $8.50 per kilogram.

Perfect aquaculture storm

The explosion in demand for tilapia has come together with equal advances in technology and investment that allowed farms to produce tilapia to meet the demand and improve productivity. Breeding programs have provided fish that grow faster, provide more fillet, and cost less to grow.

Nutritional studies have lowered feed costs. Polyculture with shrimp and other fish has lowered production costs. Integration with irrigated aquaculture has lowered production costs and eliminated effluent disposal concerns. Water treatment technology has increased the number of fish that are grown with each liter of water.

Better equipment in processing has increased yield and shelf life. Markets for byproducts have provided additional revenues and decreased disposal costs. Better transportation equipment and cold-storage facilities have improved fillet quality and further lengthened effective shelf life.

Next stage: value-added products and branding

Tilapia have spread rapidly from ethnic restaurants into chain restaurants and casual dining establishments. The other big market segment just opening includes the hypermarkets, club stores, and other mass merchandisers. For these retailers, low-cost, high-quality tilapia fillets are an ideal product that can be offered year-round. Because of the off-shore production and processing, the prices are likely to remain low compared to any similar quality seafood product.

Value adding is also going to expand. Already, fillets are deep-skinned to remove subdermal fats and improve consistency. Fillets are more carefully trimmed to remove belly flaps and thin sections on the margins of the fillets. Another common postfillet process is to dip the fillets in an ozonated water bath. This serves to further reduce surface bacteria and extend shelf life. Fillets are individually quick frozen, then wrapped and sold in 1- and 2-kg sealable freezer bags.

Other value-added tilapia products that will appear soon include breaded fillets, microwave-ready dishes, sashi-mi, marinated fish, and smoked fish. With fillets of 100-200 g, a good portion size, tilapia are an ideal base for breading, marinating, and ready-for-cooking meal packaging. By conducting the additional processing in the producing country where the fish are filleted, costs can be minimized.

Several major tilapia producers have branded their products to differentiate them from other tilapia. The most successful of these are Rain Forest, Lake Harvest, Regal Springs, Tropical, and Top Tim. Each of these brands represents vertically integrated tilapia farm operations that invested in strong quality and marketing programs.

Further brand awareness is likely to be a central goal as producers strive to open new markets and maintain their market shares. This branding is likely to follow many of the strategies developed in the poultry industry, which include building on a basic brand with new product forms. This is already the case with brands that offer several size and packaging options.

Tilapia products are rapidly moving into more markets in North America and elsewhere. Basic fresh and frozen fillets are becoming common in the restaurant trade as well as most grocery stores. As these products become better known, brands and additional product forms will become more important in the marketplace.

(Editor’s Note: This article was originally published in the December 2003 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

-

Kevin Fitzsimmons, Ph.D.

Environmental Research Lab

Department of Soil, Water, and Environmental Science

University of Arizona

2601 E. Airport Drive

Tucson, Arizona 85706 USA[117,100,101,46,97,110,111,122,105,114,97,46,103,97,64,122,116,105,102,118,101,107]

Tagged With

Related Posts

Responsibility

A helping hand to lend: UK aquaculture seeks to broaden its horizons

Aquaculture is an essential contributor to the world food security challenge, and every stakeholder has a role to play in the sector’s evolution, delegates were told at the recent Aquaculture’s Global Outlook: Embracing Internationality seminar in Edinburgh, Scotland.

Health & Welfare

Aquaculture genomics: Progress in identifying species genetics continues

The continued application of genome research to aquaculture will provide unprecedented accuracy for genetic selection of performance and production traits.

Intelligence

What will it take to make tilapia great again?

Once a darling of the sustainable seafood crowd for its vegetarian diet and potential to feed the world’s growing population, mild-mannered tilapia now has an image problem that may be causing a dip in consumption levels.

Health & Welfare

Sizing up TiLV and its potential impact on tilapia production

An international research effort has commenced to find a solution for Tilapia Lake Virus (TiLV), a contagion causing high rates of mortality in farmed and wild tilapia stocks in Israel, Colombia, Ecuador, Egypt and Thailand.