Alltech Takes Mysticism Out Of Feed Production Numbers

Editor’s note: The following column is the second in a series of columns written by GAA Communications Manager Steven Hedlund. Titled “Communicator’s Corner,” the column profiles aquaculture and seafood professionals whose leadership, sense of innovation and emphasis on education and communication sets them apart. The column will also appear in the March-April issue of the Global Aquaculture Advocate.

Global animal feed production is projected to exceed the elusive 1-billion-metric-ton mark in 2014, according to Alltech, one of the world’s leading animal health companies.

In truth, simply estimating global animal feed production, especially aqua feed production, is an elusive task.

About four years ago, executives at Alltech, including Aidan Connolly, the company’s vice president, identified a void in the availability of reliable, up-to-date statistics on animal feed production. The animal feed production industry is fragmented, and state-funded organizations like the Food and Agriculture Organization of the United Nations find it increasingly difficult to gather and maintain figures on animal feed production due to limited resources.

About four years ago, executives at Alltech, including Aidan Connolly, the company’s vice president, identified a void in the availability of reliable, up-to-date statistics on animal feed production. The animal feed production industry is fragmented, and state-funded organizations like the Food and Agriculture Organization of the United Nations find it increasingly difficult to gather and maintain figures on animal feed production due to limited resources.

Yet the information is so valuable to the animal feed and food production industries.

“We identified about 100 organizations that would be interested in this information,” said Connolly, who has worked for Alltech for 24 years.

So Connolly and his fellow executives put their heads together and came up with a solution — get Alltech’s 600-plus salespeople to survey the thousands of feed mills they visit annually. The survey results would be used to compile an annual report on animal feed production.

On the eve of the International Production & Processing Expo in Atlanta, Georgia, USA, on Jan. 27, Connolly presented the results of alltechglobalfeedsummary2014, its third annual report on animal feed production, during a 45-minute webinar.

Global animal feed production totaled 963 million metric tons in 2013, up only 1% from 2012, according to Alltech, whose more than 600 salespeople polled 28,196 feed mills from 130 countries in December. Connolly attributed the marginal increase in animal feed production to high raw material costs, influenced by a series of droughts worldwide, and flattening production in China and the United States, the world’s two largest animal feed producers.

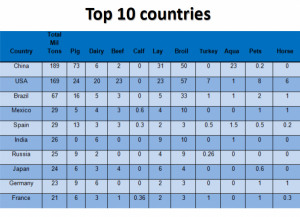

In 2013, China was the world’s No. 1 animal feed producer at 189 million metric tons, followed by the United States at 169 million metric tons, Brazil and Mexico at 67 million metric tons each, and Spain at 29 million metric tons. Rounding out the top 10 were India, Russia, Japan, Germany and France.

There are 28,196 feed mills worldwide, with Asia representing just less than half of the total at 13,266. North America and Europe followed at 5,736 and 4,886, respectively.

The animal feed production industry is now valued at about U.S. $500 billion, up from the previous estimate of U.S. $350 billion. Higher feed prices and more accurate survey results fueled the increase, but feed prices are expected to fall in 2014, as is the industry’s value, said Connolly.

Both China and the United States are expected to bounce back in 2014, and production in Brazil and Mexico continue to grow, said Connolly. Consequently, global animal feed production is forecasted to surpass 1 billion metric tons this year.

According to the 2014 Global Feed Survey, aqua feed, at 40 million metric tons, represents only about 4% of global  animal feed production.

animal feed production.

However, aqua feed production is up from 34.4 million metric tons in 2012 and 29.7 million metric tons in 2011, by far the fastest growing segment of animal feed production. It’s expected to be the fastest growing segment again this year, said Connolly.

“The number is still quite small. It’s just 4% of the world’s animal feed production,” Connolly continued. “But it’s much more consequential in China and throughout Asia.”

By region, Asia is by far the world’s largest aqua feed producer, at 31 million metric tons, more than three-quarters of the total. Europe, Latin America and North America followed at 3.8 million metric tons, 3 million metric tons and 2 million metric tons, respectively. By country, China is by far the world’s largest aqua feed producer, at 23 million metric tons.

During the webinar, Connolly addressed the challenge of compiling statistics on aqua feed production. Alltech adjusted figures for aqua feed in its 2014 survey results after learning that its 2013 figures were too high.

“Many, many people try to evaluate the numbers for aqua feed globally, and most of them give up [because] it’s too difficult,” explained Connolly. “It’s extremely difficult because there may be political reasons for [inflating] the numbers. And aquaculture is quite tricky because a lot of feed is produced seasonally, so … you can get a number that is not really representative of what happens during the year.”

In a one-on-one interview after the webinar, Connolly addressed aqua feed in more depth. He said to expect aqua feed prices to generally trend downward in 2014, citing declining raw material costs as a result of increased production.

Connolly also shared his thoughts on the need for aquaculture to better tell its story and on the emergence of third-party certification.

“Unfortunately, some people like to tear apart aquaculture,” he said. “It’s very important to protect the brand of aquaculture.”

Aquaculture has a great story to tell, said Connolly, but it doesn’t always get told. Its attributes are numerous: Fish, especially oily fish, are high in heart-healthy omega-3 fatty acids. Fish convert feed protein to food protein more efficiently than any other animal. Aquaculture is a more sustainable means of growing the world’s seafood supply than wild fisheries production.

In addressing the emergence of third-party certification programs such as Best Aquaculture Practices, Connolly encouraged transparency throughout the aquaculture production chain, including feed mills.

“All other proteins face the issue of traceability,” he said. “The question is, ‘How do I convince the consumer that the industry is looking out for their interests?’ Consumers are skeptical. But third-party [certification] programs can alleviate that skepticism.”