Varied conditions require tailored solutions

Risk management is as vital to the aquaculture industry as to any other industry. Perhaps more so, for aquaculture deals with living organisms that by their nature can be prone to unpredictability, randomness and fortuitous events. The organisms do not always respond to our human desire to control their environments.

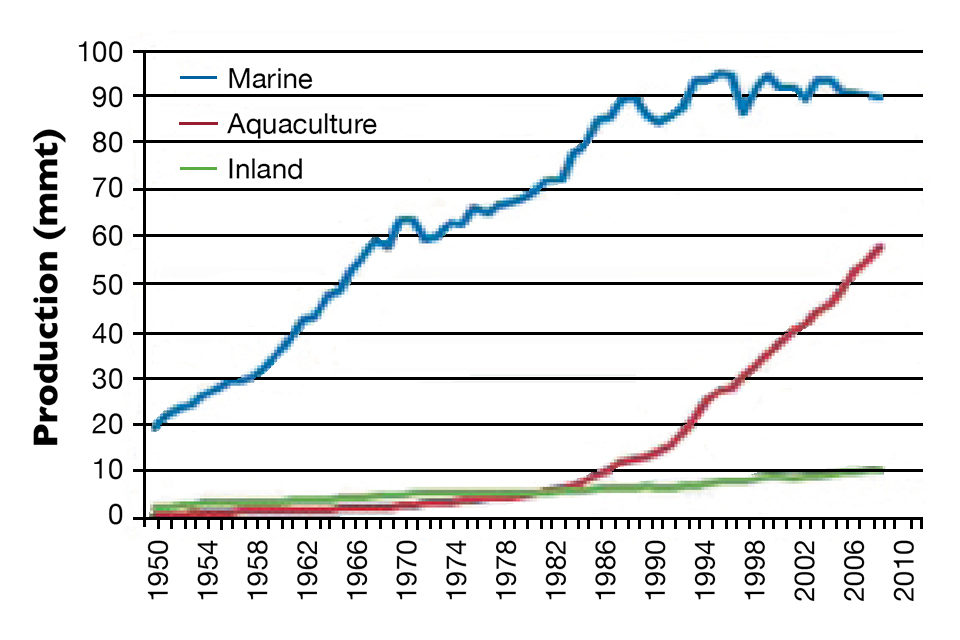

As the importance of aquaculture grows (Fig. 1), particularly in emerging markets, the industry will require well-planned insurance programs that keep the balance sheets of aquaculture investments, big or small, in line with financial feasibility. By increasing scale in order to support demand, insurance solutions backed by the reinsurance market can allow lesser fish farms to function among the bigger players.

Aquaculture – reinsurance market

In a world with increasing globalization and rising new economic powerhouses like Brazil, China and India, aquaculture is a niche insurance market that depends almost entirely on the support of the reinsurance market. Currently, only six or seven reinsurers worldwide have the ongoing will, capacity and expertise to directly analyze, rate and issue terms and conditions for aquaculture risks, which are then presented by insurance companies to their clients, the insured.

Two or three of the reinsurers working from the London market are considered leaders, meaning they issue the rates, terms and conditions and have enough financial capacity to provide cover. The rest – some in the London market and one or two in continental Europe – are followers.

Up the ladder, other reinsurers (usually the mammoth capacity providers like Munich Re, Swiss Re, Hannover Re, Partner Re and SCOR) provide retrocession or “reinsurance of reinsurance” to the reinsurers, directly supporting the insurance companies, when needed, and when enough scale in terms of premium value exists. There may therefore be a need to spread the risk up the ladder.

Expanding industry

A United Nations Food and Agriculture Organization study published in 2006 indicated that, as a conservative estimate, only 7,500 to 8,000 aquaculture policies were in effect worldwide. This represented only about 1 percent of insurance premiums for the entire agriculture sector. In contrast, coverage for crop and hail damage totaled 90 percent of premiums.

In Asia’s aquaculture-producing countries, such policies were mainly issued on the basis of specific named perils. In other regions, they were mainly issued on an “all risks” basis to cover everything but duly excluded factors.

However, aquaculture is growing as an economic activity, so insurance/reinsurance requests linked with the growth of emerging markets and investments in agro-specialized teams by both brokers and reinsurers are on the rise.

Aquaculture insurance broadly considers two main types of growing systems. Onshore risks cover around 11 perils, while offshore risks address around eight perils, depending on the wordings of the markets that issue the terms and conditions. Specific sub-products cover shrimp farms, mollusks and other species. Intensive or semi-intensive farms are also more likely to be covered to the detriment of extensive farms.

Although insurance applicants’ instincts generally request full coverage, tailor-made solutions are most commonly provided – especially in emerging markets like Brazil.

Emerging markets

With vast shrimp farms and tilapia bred behind dams built for huge livestock herds, Brazil’s fish farmers need tailor-made solutions to the realities of the terrain. Many times, such farms are of utmost importance for local, regional and national economies. Standardized solutions with standardized premiums out of the range of many farmers can’t be expected to be accepted easily.

On the other hand, the incredible scale of the bigger fish farms and the fact that some of them complement cattle herding and/or other activities allow some farmers to believe they can accommodate occasional catastrophic losses as well as more everyday losses.

Whenever possible, trade-offs among risk exposures; commercial opportunities for brokers, insurers and reinsurers; and the real needs of the fish farmers must be created. A 1,000-hectare shrimp farm in Brazil doesn’t need to be covered against everyday losses. However, a catastrophic loss could jeopardize the future feasibility of the investment.

Reducing exposure

Insurance solutions do not lie entirely in the hands of the insurance/reinsurance markets. Mitigating factors that reduce the exposure of the insurers and reinsurers are key to decreasing the volatility of fish-farming coverage. Farmers should review whether their investments are sound and protected by preventive measures that guard against the uncertainties of the aquaculture business.

Insurances cover accidental, random and fortuitous events. They don’t cover known factors of future losses. The existence of mitigating factors can affect the potential profitability of an account and, therefore, the premium calculated to cover a certain exposure. It can also be the difference between being granted insurance cover or not.

Potential loss factors include, for instance, the quality of materials used in offshore cages and their suitability in the elements of nature, or the location and signaling of a farm. Many losses have occurred at farms exposed to ship routes. Duly tested contingency plans must be ready in case of an event, and on-site redundancy and technical expertise are essential.

Technology, cooperation

Technology also plays a part by helping to provide solutions for some of the problems of the aquaculture industry. It would be good to have more integration among fish farmers, research centers and insurers/reinsurers by means of common projects that benefit all the participating parties. Cooperative projects could make insurance viable in many situations that currently are not insurable, for whatever reason, and improve economies to benefit all the elements in the chain.

An integrated approach with the added efforts of governmental authorities and professional aquaculture entities should also be on the agenda. In many situations involving low-input farm operations, insurance is too expensive for farmers to buy. On the other hand, if the business to be insured is too small for an insurer and its supporting reinsurance markets, the answer may lie in providing limited coverage or increasing the scale of the farm by uniting with others.

The latter option leads to the dispersion of risk, hence reducing exposure, and can be achieved by establishing specific insurance schemes for a certain number of insured parties under a common banner. Government-backed programs can offset the economics of buying insurance. Institutions specializing in microcredit banking could have a role to play here.

(Editor’s Note: This article was originally published in the March/April 2012 print edition of the Global Aquaculture Advocate.)

Author

-

Nuno Meira

Reinsurance Area Manager

Blat Corredoria d’Assegurances I Reassegurances, S.L.

Tamarit 155-159 Baixos

Barcelona, Spain 08015

Tagged With

Related Posts

Intelligence

Recent farmed salmon losses put aquaculture insurance in focus

Insurance is available for a wide range of species, and will protect capital investment against events or natural hazards that affect fish health, assets and harvests. Effective risk assessment and management strategies are important.

Innovation & Investment

What you should know about aquaculture insurance

With aquaculture insurance, producers can substitute an insurance premium of a known cost for an unknown potential cost, the loss of stock.

Responsibility

Aquaculture Exchange: Michael Rubino, NOAA

Social license – a community’s acceptance and support of an industry’s presence – is a key factor in aquaculture’s growth prospects. It’s a major obstacle U.S. waters, in particular. Michael Rubino of NOAA Fisheries discusses the challenges.

Responsibility

Fairness, stability in ensuring human rights in seafood

In the last of our three-part series on advancing human rights solutions in seafood, Magdalena Lamprecht-Wallhoff shares how social investment is key to the culture and success at Regal Springs Tilapia, the world’s largest farmed tilapia producer.