Annual industry assessment shows 4 percent growth for aquafeeds

Alltech has just released its eighth annual Global Feed Survey, a compilation of estimated feed production data for this past year. It covers all regions, representing 140 countries and nearly 30,000 feed mills. As aquaculture is recognized as the fastest growing food-producing segment, it makes sense that this year, Alltech’s survey saw a growth of 4 percent in global feed production for this sector.

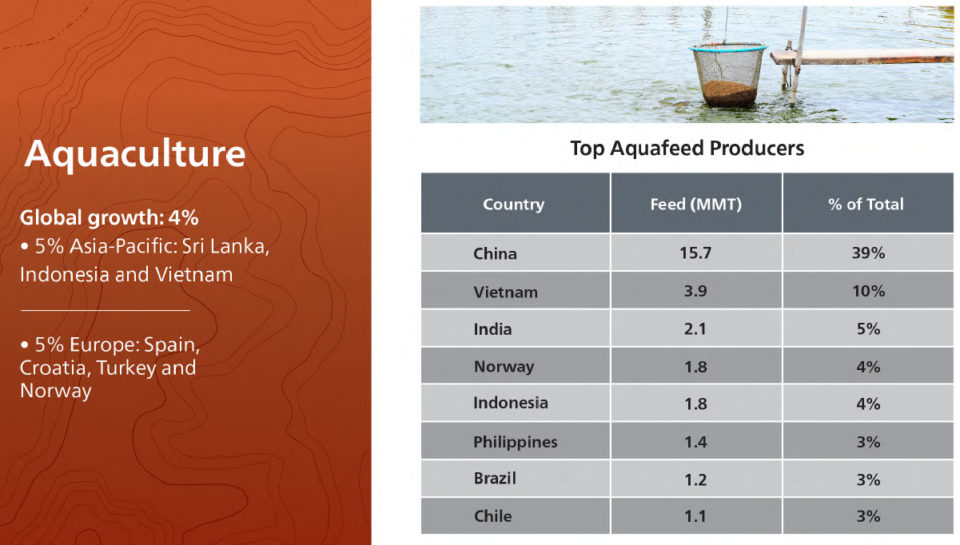

Nearly every region saw growth with the exception of Latin America. The region that produces the most aquaculture feed, the Asia-Pacific, increased feed production by 5 percent. This is primarily due to growth in larger producing countries such as Vietnam, India, Indonesia, but also smaller producing countries such as Sri Lanka, Nepal and Myanmar. The region’s leader and the country that by far produces more aquaculture feed than any other, China, also grew at 1 percent over last year.

Europe’s aquaculture feed production matched the growth of the Asia-Pacific region in percentage, but not in tonnage. Norway, the region’s largest aquaculture feed producer, grew by 7 percent, as did Turkey, the second-largest producer. The largest growth in feed production was in Spain, which added about 38,000 more metric tons to its feed production. Other countries’ feed production remained relatively flat or showed small decreases.

Africa was the only other region to see growth at 1 percent over last year. Countries such as Seychelles, Sudan and the Ivory Coast all saw increases, though in comparison to larger producing countries, the tonnages are quite small. North America didn’t demonstrate any growth and aquaculture is one area that the United States and Canada are nearly matched. The Middle East also remained flat in its feed production, the presence of aquafeed production in countries such as Iran, Israel, Saudi Arabia and Oman.

In total, it is estimated that nearly 4 million metric tons of aquaculture feed was produced in Latin America in 2018. This is a very small decline over last year’s estimate. Any decrease across an entire region requires further scrutiny and really upon doing so, it is perhaps not so surprising this region saw less production.

While the industry as a whole is growing, certain challenges within the Latin America region are causing internal strife and these economic issues ripple into multiple industries. The small decline over last year is due in large part to Venezuela, Colombia and Nicaragua, all showing fairly significant declines in aquaculture feed production, most likely due to their volatile economies at present. The biggest producer of the region, Brazil, did see a growth of 4 percent feed production and the second highest, Chile, remained flat.

Overall, it is expected that aquaculture production continues to grow, and the feed production associated with it to grow as well, though to some extent this will be affected by improved feed conversion ratios as well as technologies such as sensors which improve the efficiencies of administration of feeds and reduce waste.

It must also be considered what aquafeed will look like in the future. With the advent of alternative proteins such as insects, algae and bacteria, there is the possibility that down the road the Alltech Global Feed Survey will incorporate these alternative feed sources. It is also conceivable that these feeds will be collected using new methods combining the efforts of the Internet of Things (IOT) and other technologies such as sensors in feed mills and on the farm. All these will enable data collection for improved insights regarding the aquaculture industry and indeed other animal protein sectors.

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

Tagged With

Related Posts

Aquafeeds

A push for rapeseed as a viable aquafeed ingredient

One Germany-based company says rapeseed protein concentrate, or RPC, can help aquafeed manufacturers meet growing demand.

Aquafeeds

A new nutrient for aquaculture, from microbes that consume carbon waste

Biotechnology firm NovoNutrients aims to produce a line of nutraceutical aquafeed additives as well as a bulk feed ingredient that can supplement fishmeal. Its process includes feeding carbon dioxide from industrial gas to a “microbial consortium” starring hydrogen-oxidizing bacteria.

Innovation & Investment

Global Aquaculture Innovation Award finalist: VakSea

An orally administered vaccine product holds great promise for aquaculture, and Maryland-based startup VakSea is on the cusp of providing one. Sensing a major opportunity, the company’s focus has pivoted to shrimp.

Aquafeeds

A look at phospholipids in aquafeeds

Phospholipids are the major constituents of cell membranes and are vital to the normal function of every cell and organ. The inclusion of phospholipids in aquafeeds ensures increased growth, better survival and stress resistance, and prevention of skeletal deformities of larval and juvenile stages of fish and shellfish species.