Significant potential for large-scale, intensive, organic farms

Freshwater prawns are farmed in almost all states in Brazil, although the industry is concentrated in the southeast region, mainly the state of Espirito Santo. The industry is based on small farms, and the Malaysian or giant freshwater prawn (Macrobrachium rosenbergii) is the only species currently reared commercially. However, important native species like the Amazon River prawn (M. amazonicum) are harvested by fisheries.

In 2001, a multidisciplinary and multi-institutional program for the development of farming technology for Macrobrachium was started in Brazil. The program covers all phases of the production process, and considers economic and social aspects, environmental impacts, and animal welfare. Currently, more than 20 senior scientists and graduate students are involved.

There are two Macrobrachium producer associations and one cooperative. The latter has a hatchery, processing plant, and seines and other equipment shared by members. The Working Group on Freshwater Prawns – GTCAD – includes farmers, government institutions, technicians, and scientists. Its main objective is to obtain, organize, and spread information on freshwater prawn farming in Brazil.

Seedstock production

Five hatcheries regularly produce seedstock and at least five others work sporadically to produce a total of about 30 million postlarvae (PL) annually. However, during 2003, production decreased to about 10 million PL because of problems at two of the hatcheries. A production improvement is expected for the current year.

Flow-through, static recirculating, and dynamic recirculating systems are used in the hatcheries. Larviculture generally involves one phase, with zoea I animals stocked at 80 to 100 per liter and raised to the time they metamorphose. However, some hatcheries do high-density prestocking at 400 to 800 larvae per liter up to larval stage V or VI, after which larvae are stocked in final rearing tanks at 60 to 80 shrimp per liter.

All hatcheries are located in closed buildings. Typical larval-rearing tanks are 1-5 m3, rectangular or cylindrical, and made of fiberglass or polyethylene with inner walls painted black or blue. Hatcheries generally obtain berried females from grow-out ponds rather than maintain their own broodstock animals. Larvae are fed artemia nauplii and a prepared, inert feed. Productivity is 40 to 50 PL per liter per 30- to 35-day cycle in commercial hatcheries, while research institutions easily obtain 60 to 80 PL per liter per cycle.

Overall postlarvae production costs vary $3 to 5 per 1,000 PL. Artemia cysts, labor and depreciation are the most important cost items. Sale prices range $6 to 12 per 1,000 PL, depending on quantity purchased, time of year, and geographic region. Juveniles have been sold at $15 to 20 per 1,000 excluding packaging and transportation costs. The internal rate of return and payback estimated for hatcheries using recirculating systems have ranged 15 to 45 percent, and 3 to 5.5 years, respectively.

Farm production

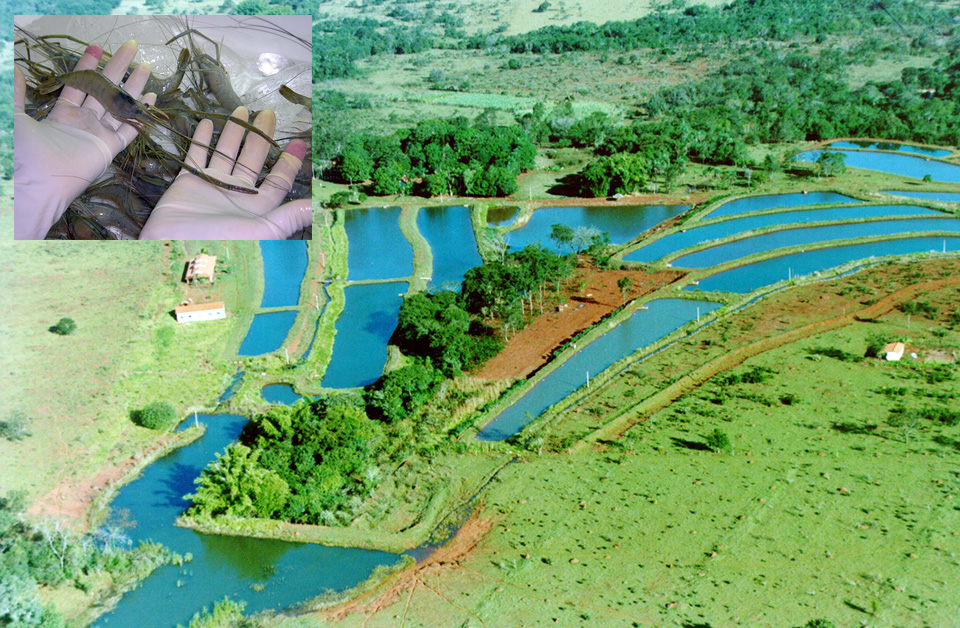

Although available data is limited, there are about 600 freshwater prawn grow-out farms in Brazil with total annual production around 400 metric tons (MT). Farms are small and usually operate 0.1-5 ha of impounded pond area. There are a few farms of about 10 ha each.

The earthen ponds are typically rectangular and 0.1-0.5 ha in size, although many farmers operate smaller ponds. Ponds are generally well designed, with a sluice gate and water circulation, but mechanical aerators are seldom used.

Generally, postlarvae are stocked in grow-out ponds, but some farmers stock juveniles. Monoculture grow-out ponds are stocked at 4 to 10 PL or juveniles per square meter. Prawns are fed using commercial pelleted feeds containing 30-40 percent protein. Diets for tilapia or marine shrimp are commonly used, while two companies market freshwater prawn diets. Farm-made feeds are not common.

Feed-conversion ratios (FCRs) run about 2.5:1. Recently, a farm using feed trays decreased FCR to 1.8:1. Survival to market size varies 50 to 80 percent, but diseases are totally absent.

Freshwater prawn culture is usually a complementary rather than principal business of Brazilian farms. Both semi-intensive monoculture and polyculture with tilapia are carried out. Monoculture uses batch or combined systems. The latter includes intermediate selective seining and a final, total harvest of ponds. New technologies that improve productivity – such as grading and the addition of artificial substrates – have not been widely introduced.

Farm production is variable because of geographic and technology differences. In the northern part of the country, the temperature is high year round. Therefore it is possible to carry out two, six-month culture cycles if PL are stocked, or three, four-month cycles if juvenile II animals are stocked. In the south of Brazil, only one or two cycles are possible.

Normally, productivity ranges 1 to 4.5 MT per hectare per year. Recently, 5.5 MT per hectare per year were obtained by a farm using artificial substrates. It may be possible to attain 7-8 MT per hectare per year using mechanical aerators, artificial substrates, and juveniles grading before stocking.

Costs, marketing, returns

The production cost of marketable prawns can reach $3 to 4 per kilogram. Feed and seed are the major costs. All prawns are consumed domestically. Whole 20- to 40-gram prawns have been sold at $4 to 8 per kilogram. Premium sizes (50 to 60 grams) and live prawns can fetch $15 per kilogram. Currently there are two processing plants dedicated to Macrobrachium processing.

Prawns are sold at the farm gate to supermarkets, restaurants, hotels, and fish stores and along the roads. Asiatic restaurants and hotels are important niche markets. Several farmers sell all production to a cooperative that packages and distribute the product.

In regions where farming throughout the year is possible, an internal rate of return of 20 percent and payback of four years are projected for small farms with 1-2 ha of ponds using low-technology, semi-intensive monoculture. An internal rate of return of 45 percent and payback of 3.5 years are expected for farms with 10 to 15 ha of ponds using high-technology culture. In areas where the climate limits the growing season to six to eight months, the estimated rate of return is about 25 percent and the payback is roughly four years for 5-ha farms.

Polyculture

Polyculture with tilapia is a new and promising alternative. Prawns are stocked in ponds at 2 to 4 PL or juveniles per square meter, and after a week, tilapia juveniles of less than 10 grams are stocked at 1 to 3 per square meter. Only the fish are considered in the daily feeding schedule. After five to eight months, all fish and prawns are harvested, with prawn production of 300 to 800 MT per hectare per cycle.

Opportunities and constraints

Brazil clearly has excellent conditions for freshwater prawn farming. It has one of the largest hydrographic basins in the world (almost 12 percent of the planet’s available freshwater), warm temperatures year round and abundant flat, low-cost land. In addition, a portion of its several thousand hectares of tilapia ponds and millions of hectares of rice fields could be easily and inexpensively adapted to polyculture and integrated culture with freshwater prawns, with significant potential for increasing profitability and environmental sustainability.

Labor is not expensive and is readily available. Excellent farming production technology is available, and research has been conducted to improve local farming strategies and management. There is a large local market, several important niche markets that pay premium prices for freshwater prawns, and an adequate infrastructure for export to international markets.

The main constraints for production and development of freshwater prawns in Brazil include the lack of sufficient seedstock and extension services. Also, unsuitable technology used in the past led to low-quality product rejected by consumers. Finally, there is a significant lack of information within official agencies regarding the profitability of freshwater prawn culture, since official support concentrated resources on the development of marine shrimp culture during the past several years. GTCAD has been working to eliminate these constraints.

Conclusion

Freshwater prawn farming in Brazil is a profitable business, and the industry is slowly expanding. It is becoming a solid and sustainable industry that promotes social and economic development with low environmental impacts. There is also significant potential for large investors to set up large-scale, intensive and organic farms to supply international markets with large prawns.

(Editor’s Note: This article was originally published in the August 2004 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Authors

-

Dr. Wagner C. Valenti

Depto. de Biologia Aplicada

FCAV, UNESP

São Paulo State University

Aquaculture Center

14884-900

Jaboticabal, São Paulo, Brazil -

Patricia M.C. Moraes-Riodades, M.Sc.

Depto. de Biologia Aplicada

FCAV, UNESP

São Paulo State University

Aquaculture Center

14884-900

Jaboticabal, São Paulo, Brazil

Related Posts

Intelligence

Culture of giant freshwater prawns in China

Farming of giant freshwater prawns is very popular in China. The Yangtze River Delta region produces more than 60 percent of the country's output. Production increases have resulted from a novel system that involves greenhouses that allow ponds to be stocked ahead by two months.

Intelligence

Adding flavor complexity to farmed barramundi

Organoleptic attributes such as flavor and aroma are among the most important factors that influence consumer acceptability and demand for fish products. Consumers have identified farmed fish as less complex and lacking “sealike” or “sea-fresh” flavors and aromas.

Health & Welfare

Ammonia toxicity degrades animal health, growth

Ammonia nitrogen occurs in aquaculture systems as a waste product of protein metabolism by aquatic animals and degradation of organic matter, or in nitrogen fertilizers. Exposure can reduce growth and increase susceptibility to diseases in aquatic species.

Innovation & Investment

Aquafeed ingredient AlgaPrime wins GAA Innovation Award

A proliferation of alternative feed ingredients has allowed aquaculture to extend the natural resources it depends on. AlgaPrime, packed with the long-chain omega-3 fatty acid DHA, is being recognized as a game-changing innovation for aquaculture feeds.