Status of halibut, cod

Farmed Norwegian Atlantic halibut and Atlantic cod have both gained acceptance among leading chefs in several countries. At last year’s Bocuse d’Or World Champion-ship in Lyon, France, farmed Atlantic halibut from Marine Harvest in Norway was chosen as one of the main raw materials to be used by the national teams that competed. The Norwegian groundfish-farming industry has clearly demonstrated its ability to deliver premium-quality products. Now it remains to be seen if it soon also can achieve economic sustainability.

Limited returns

The Norwegian aquaculture industry has tried to diversify into other species since salmon had its large-scale commercial breakthrough in the 1980s. Cod, halibut and blue mussels have been the main recipients of investment in research and development, and farms in that diversification process.

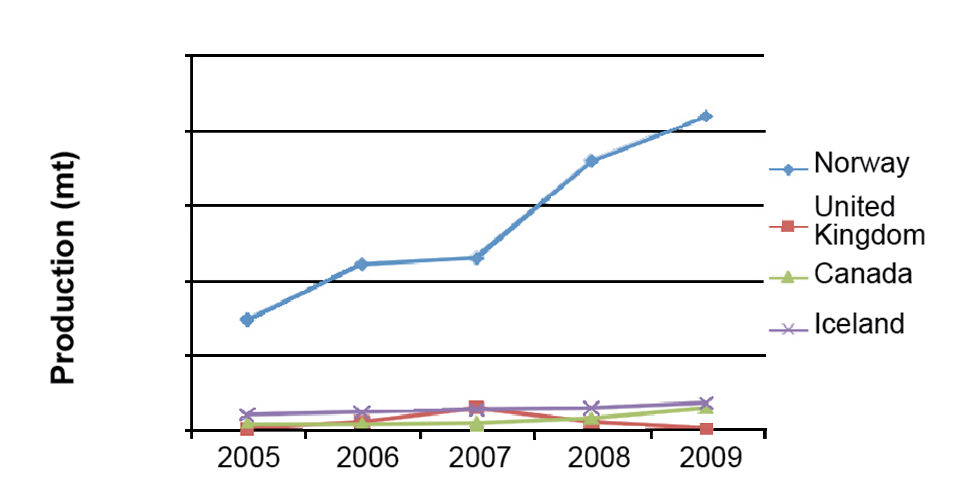

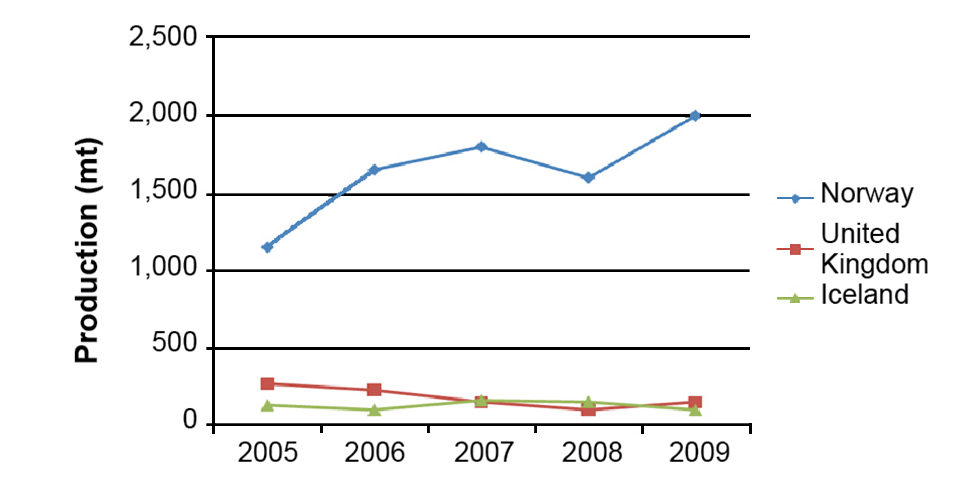

From a financial investor’s viewpoint, the overall results after several hundred million U.S. dollars were invested in these species over the last 20 years are disappointing. Norwegian production of cod is expected to be about 18,000 metric tons (MT) this year, according to Kontali Analyse, and reach around 22,000 MT next year (Fig 1). Kontali projected halibut production at about 1,600 MT for 2008 and 2,000 MT for 2009 (Fig. 2).

The returns on private investment are well into the negative, and for the industry as a whole, cod and halibut are still not profitable. These species will probably require more patience from private investors before they can provide decent returns for many companies.

Halibut – high investment, high price

Halibut’s most obvious advantage is the high prices it fetches in the market. It is definitely positioned among the more exclusive whitefish products, and is typically a product for white-tablecloth restaurants. The average farm gate price was 60 NOK ($10) in 2007. But the high price reflects high production costs and a very long production period of around four years.

Critical for the success of Atlantic halibut is the ability to develop an exclusive brand. Marine Harvest, for example, has invested much in its Sterling White Halibut brand. The company established the Sterling Academy to teach its customers about the production of halibut and preparation of halibut dishes, and help identify Marine Harvest’s halibut as a gourmet product.

High investments in working capital and marketing, together with a long payback time, probably mean that few companies can survive in this niche. Marine Harvest probably has a competitive advantage here.

Cod – not so robust?

Farmed cod’s biggest advantages are that it is widely recognized and has long traditions among consumers in Europe and North America. Fresh farmed products can be brought to market at higher quality and longer shelf life than the competing wild cod. Catches of wild cod have seen a substantial decline since the 1970s.

But since cod catches are still around 1 million MT, and the fisheries sector has improved its ability to deliver high-quality fresh cod to the market, farmed cod has not enjoyed the benefit of very high prices at the early stages, as was the case for salmon in the 1980s. Typical production costs for many cod farmers have been in the 40 to 70 NOK/kg ($5.97 to 10.46/kg) range – well above the typical farm gate prices of 20 to 30 NOK/kg ($2.98 to 4.48/kg) achieved so far.

Cod was also perceived to benefit from the development of salmon farming technology and the use of salmon-farming infrastructure in production, processing and distribution. Although this is true to some extent, salmon farmers that moved into cod farming have experienced that cod is a distinct species in many respects, with particular challenges related to feeding, quality and diseases at various stages of production.

Cod are regarded as relatively robust fish. Nevertheless, as production has scaled up, farmers have experienced their share of disease and quality issues with the fish. In the southwestern regions of Norway, production of cod was temporarily abandoned following large outbreaks of the bacterial pathogen Francisella after large investments in farms and biomass had been made. Other bacterial diseases have also emerged, so the development of vaccines now has a high priority in the industry.

Like salmon and shrimp aquaculture, cod farming will face a race between disease emergence and the industry’s ability to develop vaccines and more-resistant breeds. One disadvantage in the development of cod farming has been the late introduction of large-scale scientific breeding programs.

Growth or consolidation?

Cod farming is probably going to be hit harder than aquaculture sectors such as salmon by the tightening of financial markets following the financial crisis. The Norwegian government has awarded farm licenses that in theory allow a production of 300,000 MT. To achieve a production of 100,000 MT would require investments well above $100 million in production facilities and working capital. This capital is not available now, and expansion to such levels is probably premature before solutions to disease problems are found.

Halibut is probably going to remain an exclusive niche product in the future, with few firms producing and marketing it. Cod culture should continue to grow as disease problems are solved, but how fast?

While some have talked about cod production of 100,000 MT in 2010, it is now more likely that such levels will be reached several years later. Still, technological bottlenecks, particularly in the area of vaccine development, will be central limiting factors for the future growth of cod farming.

(Editor’s Note: This article was originally published in the November/December 2008 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

-

Ragnar Tveteras, Ph.D.

Professor, Industrial Economics

University of Stavanger

N-4036 Stavanger, Norway[111,110,46,115,105,117,64,115,97,114,101,116,101,118,116,46,114,97,110,103,97,114]

Tagged With

Related Posts

Intelligence

Aquaculture’s solid opportunity on The Rock

As aquaculture grows in Newfoundland, the socioeconomic future of this Canadian province with a population of 500,000 takes flight with it. It's a welcome development, after a two-decade slump due in part to the downturn of North Atlantic groundfish stocks.

Intelligence

Norwegian land-based salmon farmer finds Maine open for business

Nordic Aquafarms will be bringing something to Maine that’s new to the state: a salmon farm that operates on land. When complete, it will be one of the largest such facilities in the world.

Innovation & Investment

GOAL Day 3: The greater good

A jam-packed three days of important dialogue in Vancouver was capped off by a keynote from the CEO of one of Canada’s oldest seafood companies, a suite of aquafeed innovations and a moving acceptance speech from Bill Herzig, the GAA Lifetime Achievement Award recipient.

Aquafeeds

Amino acid requirements in developing marine fish

Most marine fish have pelagic eggs with large pools of free amino acids of fairly constant proportion regardless of species. The amino acids provide energy for metabolism and are an important nutritional asset for growing embryos.