Overview of current trends in the production supply chain

In this article, we analyze existing trends in the various segments of the shrimp production supply chain in India, including hatcheries, shrimp farms, feed production and exports. We also propose some strategies to help support industry resiliency and sustainability.

India has an extensive coastline of 8,118 km across nine states and four union territories. The country’s shrimp aquaculture industry is one of its growing, protein-producing sectors which earns India important foreign exchange. Rising demand for animal protein, safe for human consumption, is on the rise due to the coronavirus (COVID-19) pandemic, which has not only caused a huge transition in the global economy but also affected the shopping behavior of many people around the world.

The country’s shrimp-farming area currently encompasses more than 176,000 hectares (ha): about 160,000 ha (91 percent) are used for Pacific white shrimp (Litopenaeus vannamei) production, some 14,080 ha (8 percent) for black tiger shrimp (Penaeus monodon) culture and around 1,760 ha (1 percent) for production of freshwater giant prawn (Macrobrachium rosenbergii).

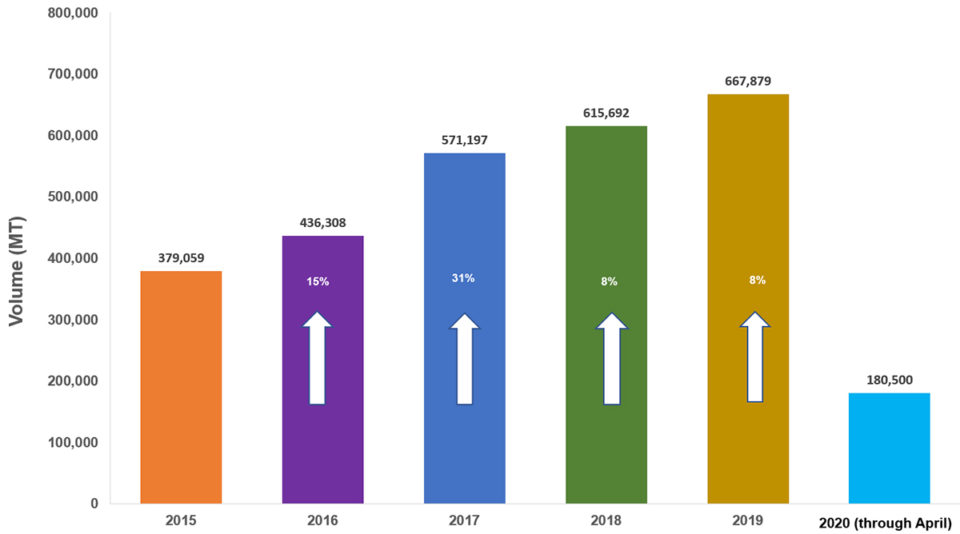

Data from the Indian Ministry of Commerce and Industry show that year-on-year (YOY) shrimp production increased by 31 percent between 2019 (804,000 metric tons, or MT) and 2018 (615,692 MT), and that shrimp exports grew by 8 percent (667,140 MT) to various countries, representing 83 percent of total shrimp production in 2019.

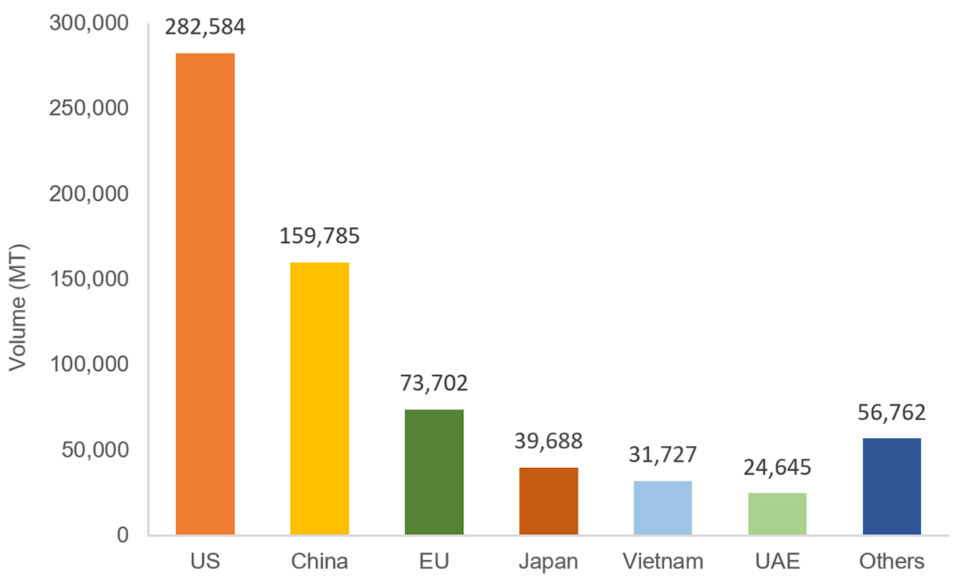

Exports were significantly driven by strong U.S. demand in the second half of last year, and India was the leading supplier of shrimp to the United States in 2019. Exports to that market grew 14 percent YOY with an export volume of 282,584 MT in 2019, when compared to the export of 247,783 MT in 2018. India exported 159,785 MT to China; 73,702 MT to the European Union (EU); 39,688 MT to Japan; 31,727 MT to Vietnam; 24,645 MT to the United Arab Emirates (UAE); and 56,762 MT to other destinations (Fig. 1).

Hatcheries

According to the Coastal Aquaculture Authority (CAA, under the Ministry of Fisheries, Animal Husbandry and Dairying), there are 311 shrimp hatcheries in India registered to import specific pathogen free (SPF) L. vannamei broodstock from 11 overseas suppliers, with an annual production capacity of 45 billion postlarvae (PLs). There are also 90 nauplii rearing centers (NRCs) with a capacity of 8.12 billion PLs that are registered with the CAA to produce seed for aquaculture farmers.

Approximately 63,430 broodstock animals were imported in the first quarter of 2020, until the COVID-19 lockdown was announced by the Government of India (The Marine Products Exports Development Authority, or MPEDA), with no new imports since lockdown. By March 2020, 16 billion PLs were produced, and of these, some 1 to 1.5 billion animals, were discarded by hatchery operators due to lack of demand by farmers, which disturbed the cycle of shrimp seed production at the hatcheries. We estimate that approximately 4 billion PLs were produced in April 2020 during the lockdown.

Hatchery operators were not able to produce seedstock during the initial period of the lockdown due to strict regulations on their operations, including various logistics aspects and labor. Also, drivers for delivery vehicles were not available to transport the PLs to distant regions.

Because of the lockdown restrictions, lack of SPF broodstock, reduced hatchery seed production and a huge demand for PLs, seedstock prices increased by around 30 percent in the last three months, and further increases are possible unless conditions change. It is worth noting that the state government of the State of Andhra Pradesh has set maximum prices for PLs, with shortages expected in the coming months.

Also, if broodstock imports do not satisfy demands, hatchery operators may resort to using farm-reared animals as non-SPF broodstock to produce PLs to meet farmers’ demand, and this would obviously affect seedstock quality. Nauplii survival during the summer would be lower, leading to severe shortages (of as many as six billion PLs) in the supply of PLs after May 2020.

Shrimp farms

In India’s shrimp farming industry, the first quarter (Q1) and early second quarter (Q2) of the year are commonly referred to as the summer crop, and this is the most active season for PL stocking. During February and March 2020, farmers were preparing to stock their ponds based on a normal PL supply situation. However, the official COVID-19 lockdown at the end of March significantly impacted the supply of PLs and the subsequent stocking of ponds, which resulted in a drastic fall in raw material prices.

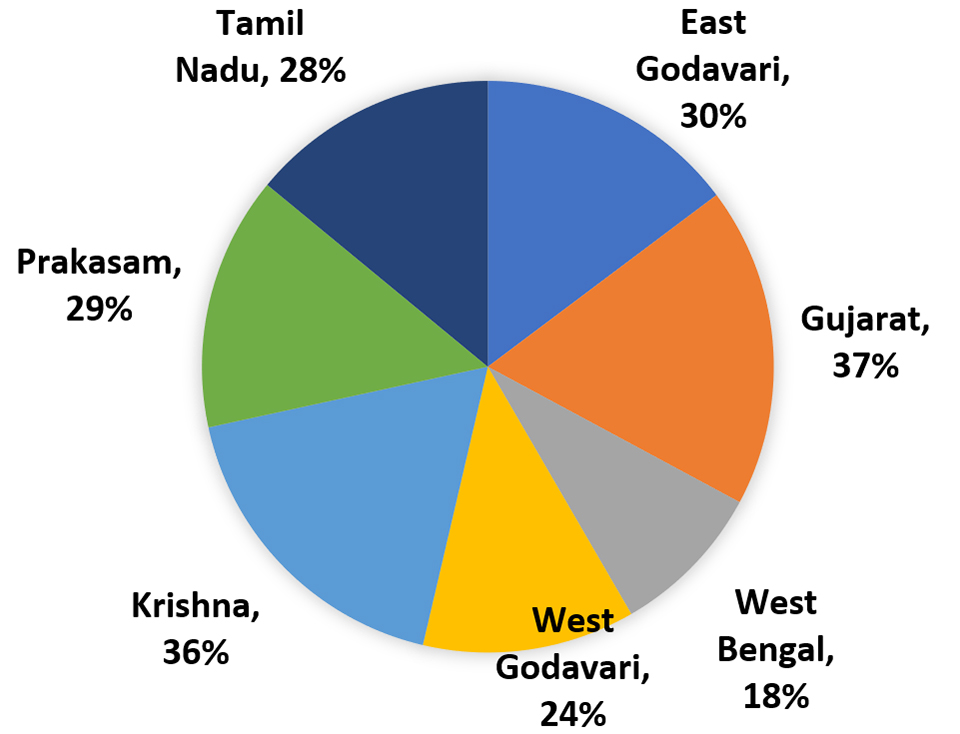

Because of the resulting uncertainty in international markets and also disease outbreaks, farmers carried out emergency harvests of ponds. Most farmers that stocked their ponds between January to early March have harvested their shrimp even at very small sizes. As a result, about 70 percent of the shrimp aquaculture area is now ready for stocking. Based on our own data gathered across the key aquaculture zones, the pond area presently stocked is approximately 30 percent (Fig. 2).

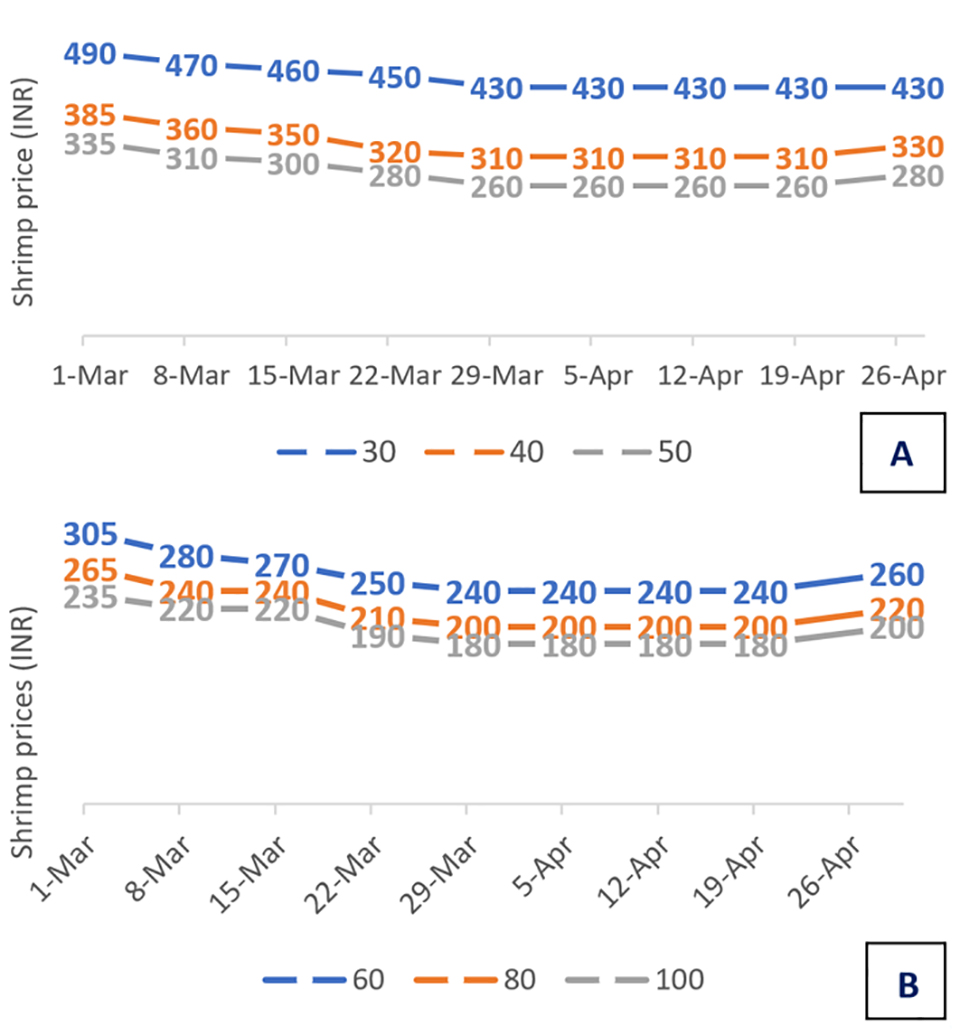

Farm gate prices for shrimp were steady from January to the first week of March 2020. However, prices started to fall during the second week of March and continued declining (Fig. 3) regardless of shrimp size (counts) – perhaps due to a dynamic international market and caution on the part of buyers – until the end of the third week of April,

However, the prices of premium counts like 30- and 40-count declined in early May 2020, while prices for the other counts increased. This may be due to a market seeing an increased volume of premium counts like 30-count as farmers who stocked in January continue to harvest. These large sizes were highly utilized in restaurants, 70 percent or more of which remain closed across the world due to the COVID-19 pandemic. In addition, medium-count shrimp can be exported to China and other destinations that purchase low-count (smaller) shrimp from India, which can also be absorbed by the domestic market.

Shrimp farmers are now starting to recover from the difficult times caused by heavily slashed prices during recent months, as prices started recovering some starting in the last week of April. Farmers appear more motivated to stock their ponds as prices keep improving. Interestingly, Mr. Mopidevi Venkataramana Rao, Andhra Pradesh’s State Minister for Animal Husbandries and Fisheries, recently stated that the government would ensure minimum prices as support for farmers. We estimate that around half of the farmers are likely to be re-stocking their farms as the situation improves and good demand in Q3 2020 is anticipated. But because 60 to 70 percent of farmers are anticipated to stock in May and June 2020, there could be a short supply of quality PLs available to farmers.

Shrimp feed industry

In 2019, more than 30 feed companies manufactured shrimp feed and produced around 1.2 million MT annually. During the first quarter of 2020, approximately 350,000 MT of shrimp feed were produced, but the output for April 2020 was estimated to be 80,000 MT, or 40 percent lower compared to April 2019 (authors’ data). With the support of the Government of India, the supply chain is now gradually coming back. The decline in feed production was caused by the COVID-19 regulations, which resulted in a manpower shortage, issues with raw materials’ logistics and fluctuating demand in the market.

Fishmeal is one of the major ingredients for shrimp feed, but in the first quarter of 2020 India produced an estimated 46 percent less fishmeal than the amount of 120,000 MT (produced in Q1 2019 (IFFO – The Marine Ingredients Organisation). For fish oil, production in Q1 2020 has dropped by about 28 percent compared to Q1 2019, when approximately 1,000 MT were produced monthly. These decreases are related to continuing issues with raw material supplies, and we expect that the demand for shrimp feed will increase as pond stocking by farmers increases.

Shrimp exports

India’s shrimp exports have had continuous growth over the past decade with year-on-year increases in volume (Fig. 4). In 2019, shrimp exports generated revenues of (U.S.) $5 billion (Ministry of Commerce and Industry, Government of India). The country currently has about 366 MPEDA-approved seafood export companies and 60 cold storage facilities. Through March 2020, about 230,000 MT of shrimp were produced, of which 180,500 MT (78 percent) were exported to various global markets.

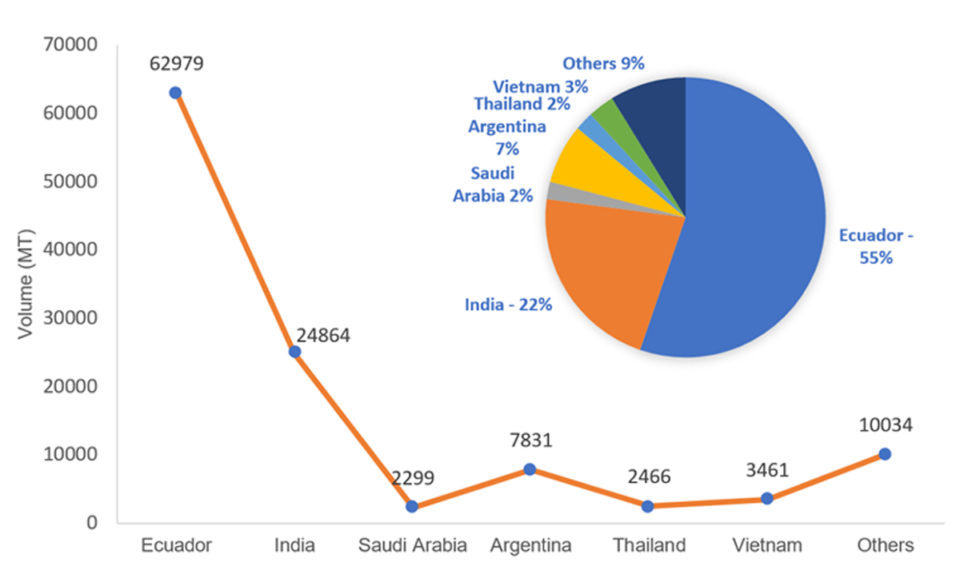

The top export destinations for India in Q1 2020 was the United States, with about 68,894 MT, followed by 24,848 MT to China, which resumed its shrimp imports from India. Though Ecuador is currently the major supplier to China, India is next in terms of volume with a contribution of 22 percent of the overall imports of shrimp in China (Fig. 5). Based on our internal data, approximately 25,000 MT of shrimp were in cold storage for future orders, and the Government of Andhra Pradesh supported the industry by opening major ports like Vizagapatnam, Kakinada and Krishnapatnam to resume exports.

In addition to export market, farmed shrimp are also being sold in domestic markets, which was a long-awaited development for industry stakeholders, and which coincided with the low availability of wild captured product due to COVID-19 restrictions. Most interestingly, Japan has reduced import inspection sampling frequency for black tiger shrimp, which should help exports to that country in 2020. There are expectations that India’s shrimp exports may increase due to possible global shortages in the near future.

The way forward

The need to stabilize the current conditions is especially important, as the availability of labor and logistics for proper functioning of the industry remains a key challenge across different segments of the industry. Government support is needed in terms of finance and security to help the shrimp farming community.

We recommend better pond and feed management practices to improve responsible yields and for successful and profitable production. A promising action to consider would be to implement low stocking density with a clear focus on medium count for the international and domestic markets.

And regarding markets, increasing awareness of shrimp in the domestic side would help support the industry and should include efforts towards more sustainable production models. A strong domestic demand would help sustain the industry in dealing with the potential risks and fluctuations of international markets.

Internationally, more innovative approaches to reach global consumers would help the industry to bounce back. Some examples of innovative approaches include India’s National Egg Coordination Committee (NECC), where egg farmers have the right to determine the price for their produce. Also, the Hass avocado model – where avocado sales expansion was achieved primarily through rising demand by promotion and not by lowering material price – can provide insight into how to gain momentum and sustain the Indian shrimp farming industry.

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Authors

-

Edward Gnana Jothi George, Ph.D.

Regional Technical Manager

Kemin AquaScience

#C3, 1st Street, Ambattur Industrial Estate, Chennai 600 058, India -

Sugumar Chinnadurai

Regional Director – South Asia

Kemin AquaScience

#C3, 1st Street, Ambattur Industrial Estate, Chennai 600 058, India -

Vidya A

Regional Technical Manager

Kemin AquaScience

#C3, 1st Street, Ambattur Industrial Estate, Chennai 600 058, India

Tagged With

Related Posts

Innovation & Investment

The coronavirus pandemic’s influence on aquaculture priorities

There are lessons to be learned for aquaculture amid the coronavirus pandemic that's impacting life and business at every level. We explore a few perspectives.

Innovation & Investment

Robins McIntosh: Florida RAS shrimp farm the first of many

CP Foods’ Robins McIntosh is turning a 40-acre site in Florida into a next-generation shrimp farm, producing 1,000 tons annually with zero waste.

Health & Welfare

How can Norway defeat pancreatic disease in salmon? By detecting it faster.

Polish pathogen diagnostics group will soon launch a test system that can identify the costly pancreatic disease (and six others) in just 10 minutes.

Intelligence

COVID-19 has the West Coast shellfish sector on hold

The impacts of the coronavirus (COVID-19) pandemic on the industry are vast. In the Pacific Northwest, some producers are faring better than others.