Improvements in production chain could boost output, increase exports

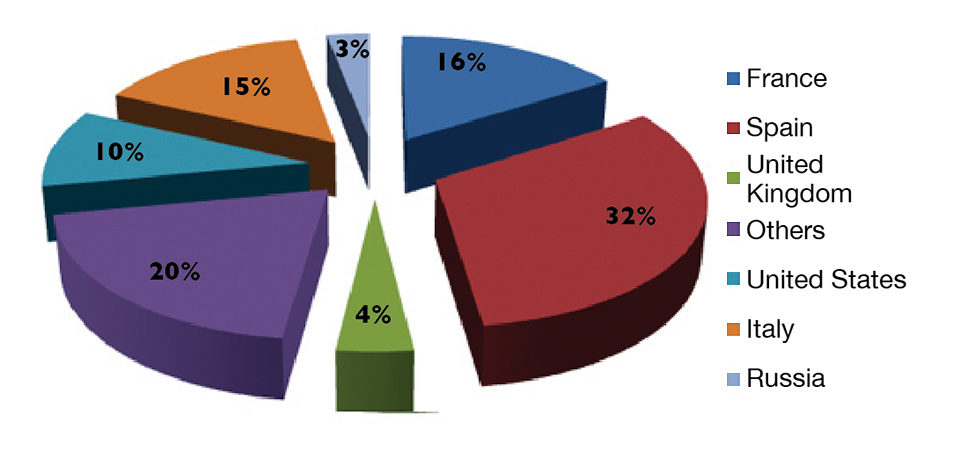

Mussel culture in Chile is based on the production of three main species: the chorito or Chilean mussel (Mytilus chilensis), the cholga mussel (Aulacomya ater) and the giant or choro mussel (Choromytilus chorus). Mussel aquaculture has developed locally since the 1960s, with production increasing substantially in the last decade. By 2000, production was around 12,000 metric tons (MT), and by 2009 about 168,000 MT were harvested. Much of the production of Chilean mussels is exported to the European market. The production of cholga and giant mussels is consumed locally.

Because of the geographical conditions and water quality, the activity is concentrated in the Lakes area in Region X. According to data from Sernapesca (Servicio Nacional de Pesca, National Fisheries Services), the areas of Calbuco and Chiloé contribute 99.8 percent of the total landings of farmed mussels. In 2010, processed mussels reached sixth place in the region’s exports, contributing a value of $39 million.

Production processes

This industry currently has four distinct production processes: the production of seed, which currently comes from the capture of wild seed, for production technologies are not yet economically viable; grow-out to market size using suspended systems; transformation of the meat products to frozen and canned products; and marketing to mostly foreign export markets (Fig. 1).

The Integrated Territorial Program for Mussels reported that the industry is a productive conglomerate composed of 63 seed producers, 1,120 grow-out centers, 40 processing plants and approximately 60 exporting agents.

Standardization needed

While Chile’s mussel culture industry has entered a very important phase of growth, challenges remain, especially in the seed production and grow-out components. This contrasts sharply with the level of the processing plants and marketing, which have production technologies and expertise to satisfy the requirements of each market.

This results in ineffective coupling and standardization of all the production links, increasing production costs. In turn, the small and medium producers of mussels do not have management systems to respond adequately to the requirements of processing plants. Therefore, their production suffers from low prices, generating narrow profit margins that prevent scaling up and additional quality improvements.

Because of this, the Chilean or chorito mussel has been positioned as a product mainly for bulk unprocessed exports at medium to low prices. The mussels have had to face the foreign market preferences for domestic products and for value-added and certified products like those from New Zealand and Ireland.

National brand

To improve the competitiveness of the industry and reduce the risks associated with fluctuations in current markets, efforts have been focused on diversification into new markets in Latin America and Asia, and establishing a so-called national brand for Chilean mussels that clearly represents the quality of their origin.

At Cultivos Marinos San Agustín Ltda., the company’s value proposition is to raise the standards of Chilean farmed mussels through various certifications that would demonstrate environmental stewardship, as well as quality and social responsibility. This differentiation will lead to better prices – estimated at up to 40 percent higher for value-added products – in organic markets that are currently small but growing 20 percent annually, mainly in the United States and European Union.

To accomplish these goals, the company is working on several fronts, including certifying its growout phase processes as organic, and obtaining a major contract with an international company for processing to organic standards. Cultivos Marinos San Agustín Ltda. is currently awaiting a final audit to begin harvesting in the third quarter of 2011. By 2014, it expects to reach 1,000 MT of annual mussel production.

(Editor’s Note: This article was originally published in the September/October 2011 print edition of the Global Aquaculture Advocate.)

Authors

-

Carolina Rojas Mogollón

Cultivos Marinos San Agustín Ltda.

San Agustin s/n, Calbuco

Región de Los Lagos, Chile -

José Troncoso

Cultivos Marinos San Agustín Ltda.

San Agustin s/n, Calbuco

Región de Los Lagos, Chile

Tagged With

Related Posts

Responsibility

A look at integrated multi-trophic aquaculture

In integrated multi-trophic aquaculture, farmers combine the cultivation of fed species such as finfish or shrimp with extractive seaweeds, aquatic plants and shellfish and other invertebrates that recapture organic and inorganic particulate nutrients for their growth.

Intelligence

An emerging shellfish farming industry in Namibia

For shellfish farming in Namibia to continue expanding, industry must better comply with approved sanitation standards. The Namibian Shellfish Monitoring and Sanitation Program, currently in development, will help.

Intelligence

Aquaculture UK: Stepping up to the plate

There’s considerable opportunity to grow the UK aquaculture industry. At the Aquaculture UK exhibition and conference in Aviemore, Scotland shows the way.

Responsibility

Aquaculture certification steers to zone management

Zone management is an emerging field of interest among industry stakeholders. Experts say it will aid in controlling diseases and in determining carrying capacities. We take a closer look at the management tool’s potential.