Aquaculture products are well introduced in Catalonia and accepted by consumers

Gilthead sea bream is the second most important farmed fish traded in the Catalonia region of Spain. As reported by the Catalan Department of Agriculture, Livestock, Fisheries, Food and Environment, it is also the top farmed fish produced in the region. In Mercabarna, the main wholesale market in Catalonia, gilthead sea bream represented 24.5 percent of the sales of fresh farmed fish in 2010. Although that percentage then decreased, the Ministry of Agriculture, Food and Environment has reported a recent resurgence in sea bream sales.

Gilthead sea bream can be found in several presentation formats in Catalonia, with whole fresh fish the most common. However, other presentations are being introduced, such as frozen and vacuum-packaged and precooked fillets, among others.

Consumer survey

To explore consumers’ preferences toward sea bream in Catalonia, the authors prepared a structured questionnaire and surveyed 160 consumers of gilthead sea bream. The choice experiment considered the following descriptors for sea bream:

- Presentation, considering fresh whole fish, fresh fillets and frozen fillets.

- Origin, which will help determine the necessity of promoting a regional label for product differentiation. Three origins were chosen: Catalonia, Andalusia and Greece as a foreign origin.|

- Production system, which will allow assessing the promotion of a farmed product as a desirable attribute

- Price.

The study was funded by the Cluster Plan to Promote Aquiculture in Catalonia (AqüiCAT), led by Research and Technology in Food and Agriculture (IRTA) and Competitiveness for Catalonia (ACC1Ó).

Methodology

The experiment was based on the creation of a hypothetical market for the analyzed goods and services. Characterization of the object of study was accomplished through a series of descriptors (attributes and levels). These were combined by means of experimental design to create different product alternatives. The alternatives were grouped in “choice sets,” which represented changing in one or more attributes.

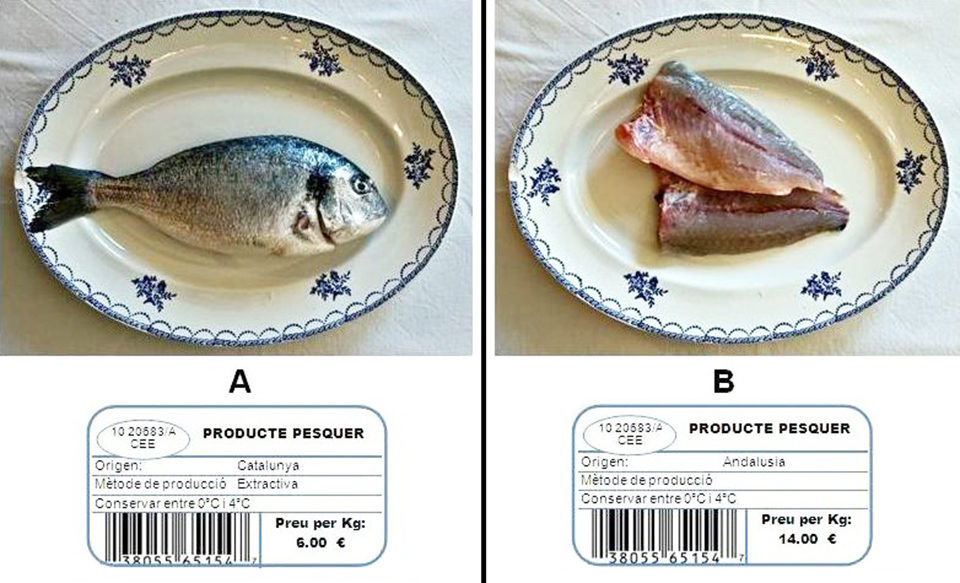

Individuals were asked to select which alternative they preferred and whether they would buy it. An example of a choice set is presented in Fig. 1.

Results

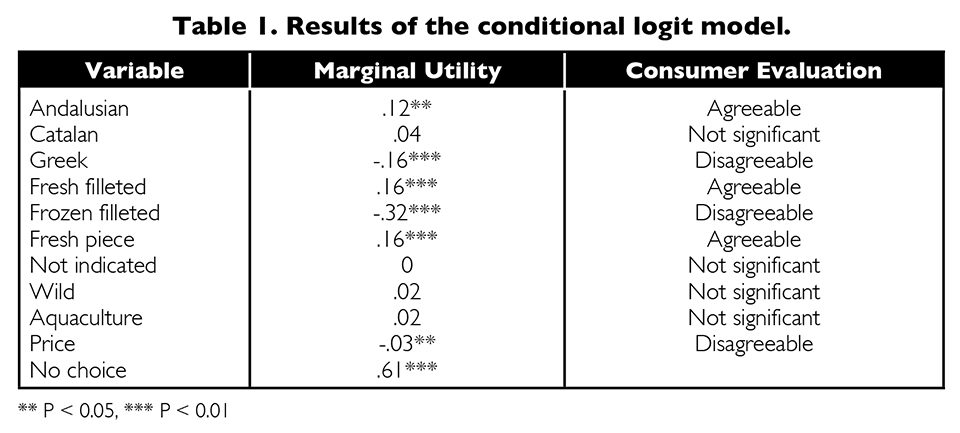

Consumers in Catalonia revealed no preference for production method, i.e., aquaculture or wild capture. The most significant attributes for consumers’ were presentation and price (Table 1). Catalonian consumers had a high preference for fresh rather than frozen product. If the product was fresh, both filleted and whole presentations were equally liked. For the origin, Catalonian consumers had a high preference for national gilthead sea bream, especially fish from Andalusia.

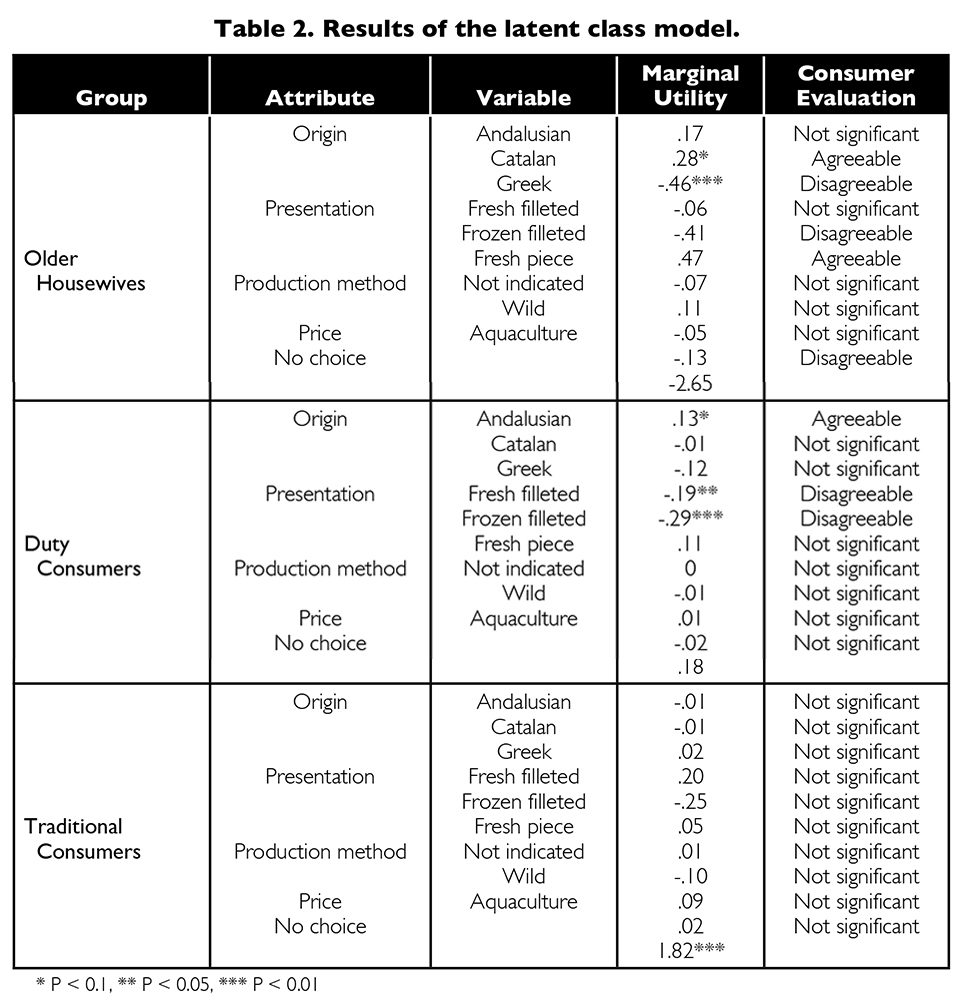

The analysis identified three latent class groups (Table 2). The first group, named Older Housewives, consisted of older female consumers who preferred traditional presentations and thus fresh, whole fish. Bream from the Catalan region was their favorite. Furthermore, they stated they would pay a premium price for it. Unfortunately for the Catalan aquaculture sector, this group represented only 9.6 percent of the sample.

The second group, identified as Duty Consumers, ate fish mainly because it is related to health and diet issues. Therefore, they did not gain a lot of pleasure from fish consumption. These younger consumers preferred a convenience product, such as ready-to-cook filleted sea bream. At 59.0 percent of the sample, Duty Consumers represented the major consumer group.

The third group was called Traditional Consumers. These respondents were used to eating fish at home since they were young. Therefore, fish consumption was an enjoyable habit. They consumed gilthead sea bream in all ways (fresh, frozen, filleted, national, foreign), not showing any preference for a determined level of an attribute.

It is noteworthy to highlight that aquaculture products are well introduced in Catalonia and accepted by consumers. None of the identified groups was influenced by the production method when buying sea bream. Even the Older Housewives, which could be expected to be more reluctant, showed acceptance toward aquaculture.

(Editor’s Note: This article was originally published in the March/April 2015 print edition of the Global Aquaculture Advocate.)

Authors

-

Cristina Escobar

CREDA – UPC – IRTA

Research Centre for Agro-Food Economy and Development

Parc Mediterrani de la Tecnologia

Edifici Esab

08660 – Castelldefels (Barcelona), Spain -

Dr. Zein Kallas

CREDA – UPC – IRTA

Research Centre for Agro-Food Economy and Development

Parc Mediterrani de la Tecnologia

Edifici Esab

08660 – Castelldefels (Barcelona), Spain -

Dr. José María Gil

CREDA – UPC – IRTA

Research Centre for Agro-Food Economy and Development

Parc Mediterrani de la Tecnologia

Edifici Esab

08660 – Castelldefels (Barcelona), Spain

Tagged With

Related Posts

Intelligence

Consumer survey explores farmed, wild seafood perceptions

What do shoppers really think about farmed and wild seafood? Commissioned by The Fishin’ Co. and the Global Aquaculture Alliance, an extensive survey conducted earlier this year sought to determine the key drivers in consumers’ seafood purchasing habits and their perception of aquaculture.

Intelligence

Changes in European consumer perceptions of farmed salmon

Household surveys have been carried out annually since 2012 in France, Germany and the UK on perceptions and consumption patterns for salmon and meat from agriculture. Results show that salmon is generally perceived as having more beneficial effects than chicken on brain development, bone development, certain cancer risks and coronary heart disease risk.

Intelligence

‘Spatiotemporal patterns’ indicate improving perceptions of aquaculture

A study led by University of California Santa Barbara researchers has found that public sentiment toward aquaculture improves over time, a potentially important development with growing interest in offshore aquaculture.

Intelligence

Adding value to tilapia to tap into U.S. market

New markets for tilapia and expansion of existing ones can be created by planning and implementing properly designed geographic strategies to meet discriminating consumer preferences. Low labor costs in most producing countries promotes value-adding by the production of fresh fillets.