More vegetable-based feed ingredients needed to grow the sector sustainably

The Brazilian aquaculture industry has experienced a fast expansion during recent years. In 1994, Brazil harvested around 30,750 metric tons (MT) of farmed freshwater fish. Although reliable projections for 2000 are not available, estimates range between 90,000 and 110,000 MT, which will represent an increase of over three times in six years.

The status of commercial freshwater fish culture in Brazil has been recently described by Lovshin and Cyrino (1998). The culture of tropical freshwater fishes has led the development of aquaculture in Brazil, where many areas throughout its territory have the required characteristics for the sustainable growth of this activity. Marine shrimp culture is another important segment, and it is located on the northeastern and northern regions of the country.

Feed industry

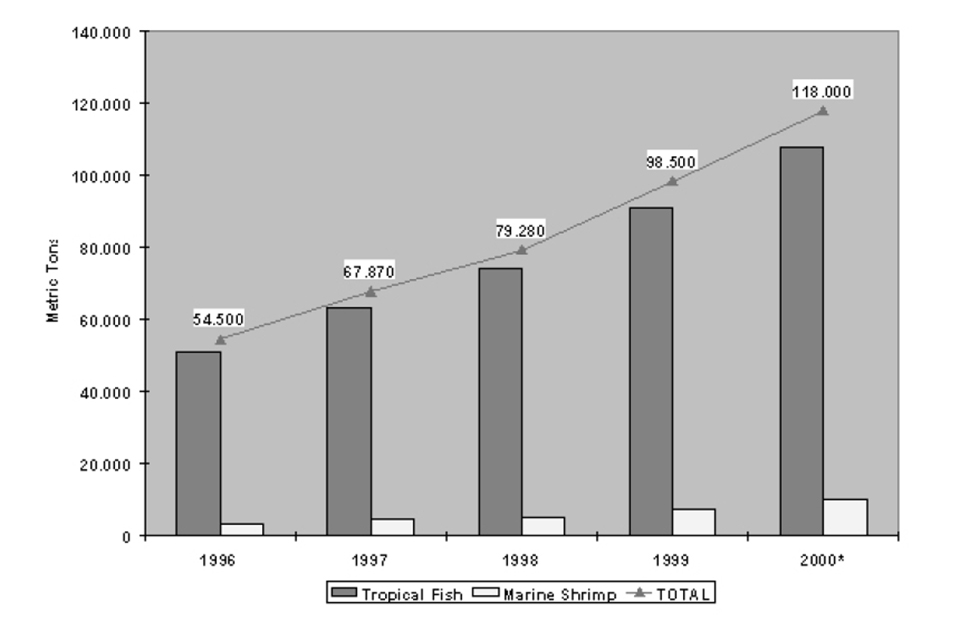

The aquaculture feed industry in Brazil has promptly reacted to the increasing demand for feeds associated with the growth of the aquaculture industry. In 1997, the Aquaculture Committee of the National Association of Feed Manufacturers (COAq/ANFAL) was created, with the major objective of developing the best strategies for the feed industry, in support of an environmentally responsible aquaculture industry. The COAq/ANFAL has recently evaluated the aquaculture feed market growth, and Fig. 1 summarizes the data available.

Extruded products represent more than 90 percent of the tropical freshwater fish feed market. This segment has grown from 51,100 MT in 1996, to 91,000 MT in 1999. In 2000, the feed industry estimates that 108,000 MT of tropical freshwater fish diets will be sold in the local market. Presently, more than 20 aquafeed manufacturers offer a wide range of more than 90 products.

The prohibitive costs involved with the importation of good quality, animal protein ingredients, together with the local availability of ingredients of plant origin, suggest that local ingredients should be more prominent in aquafeeds. However, one of the major obstacles that must be resolved is improvement in consistency and quality of local, rendered animal protein ingredients and fishmeal. The feed industry must develop technologies that will allow the use of increasing amounts of vegetable ingredients in the manufacturing of carnivorous fish diets. On the other hand, the culture of omnivorous tropical fishes like tilapia will depend more on market demand.

Fish and shrimp culture

Brazil’s freshwater tropical fish fauna is the most diverse in the world. One of the most exciting aspects of Brazilian fish culture research is the potential culture of some carnivorous species from the Amazon, Paraná- Paraguai, and São Francisco river basins. The nationallyprized food fishes (Pseudoplatystoma fasciatum and P. coruscans), which are carnivorous flat-head catfishes, can reach 2 kg while feeding on floating 40 percent crude protein, extruded diets in 18 months of culture, with an FCR of 1.8:1.

Production of marine shrimp is expected to reach about 15,000 MT in 2000, with the consumption of about 10,000 MT of pelleted feeds. Shrimp farmers are conscious of the importance of feeds, and they lead the demand for best-quality, lower-priced products, increasing competition among feed manufacturers. Typical shrimp grow-out feeds contain 28 percent crude protein, 2,800 Kcal DE per gram, and 200 ppm stable vitamin C products.

Brazil is fast becoming a major tropical aquaculture producer. It has the land, water, climate and grain resources necessary. Technical assistance and technology development to support modern fish culture is growing. Government regulations and financial aspects are being questioned and improvements demanded nationwide by the aquaculture industry. There is a general sense of strong growth and investment opportunity in the near future.

References

Lovshin, Leonard L. and Jose Eurico P. Cyrino, 1998. Status of commercial fresh water fish culture in Brazil. World Aquaculture 29(3): 23-39.

(Editor’s Note: This article was originally published in the April 2000 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

-

Silvio Romero de C. Coelho, M.S.

Aquaculture Manager

Mogiana Alimentos S.A. - Rações GUABI

Cx.P. 5011, Campinas, SP

CEP: 13.031-970 Brazil

Tagged With

Related Posts

Intelligence

Pintado culture in Brazil

Pintado, a South American carnivorous catfish that inhabits the Paraná and São Francisco River basins, is cultured in most regions of Brazil.

Intelligence

Marine fish culture in Brazil

Marine fish farming in Brazil appears promising. A new cobia research network will support industry growth through standardization, development of technology and training.

Responsibility

Brazil’s inland aquaculture

Freshwater fish culture is practiced in every state in Brazil, primarily at small-scale earthen pond facilities, but tilapia culture in reservoir cages is increasing.

Responsibility

The promise of In-Pond Raceway Systems, part 1

A promising strategy to increase fish production in static aquaculture ponds, the In-Pond Raceway System (IPRS) grows fish confined at high densities in floating or fixed raceways, instead of the animals being free in the pond.