Second-largest freshwater fish producer has potential for further development

Total fish production in India in 2018 is estimated at 6.24 million metric tons (MMT), which is close to two-thirds of the total fish production in the country from both capture and culture sources. The growth in the fish farming sector mainly comes from the freshwater aquaculture sector, as marine finfish culture is hardly practiced on a large scale. About 12.8 percent of total animal protein consumed in India comes from freshwater fish.

Historically, the Indian freshwater fish farming was based on a multi-species system. Natural fish food organisms were generated by adding organic and inorganic manure to water and the multi-species utilize this food based on the trophic system in the pond.

A combination of Indian major carps – including catla (Labeo catla), rohu (Labeo rohita) and mrigala (Cirrhinus mrigala) – were used as the main target species for culture, as well as a few Chinese carp species like silver carp (Hypophthalmichthys molitrix), grass carp (Ctenopharyngodon idella) and occasionally common carp (Cyprinus carpio). The very high level of technology developed for induced breeding of carps and the abundance of agri-byproducts used as supplemental feed led to the rapid development of freshwater aquaculture in the country.

For a long time, India did not change from this type of fish farming. Nutritionally poor feed ingredients in loose form were fed to fish using feed bags or by directly broadcasting it into the ponds. The feed conversion ratios (FCR) in this type of feeding systems range from 3 to 4 kg of feed to 1 kg of fish production. Fish are normally harvested at 1 to 1.2 kg body weight after 8 to 10 months. They are marketed in iced condition to important consumption markets, which are about 24 to 48 hours away by road.

Culture system diversification

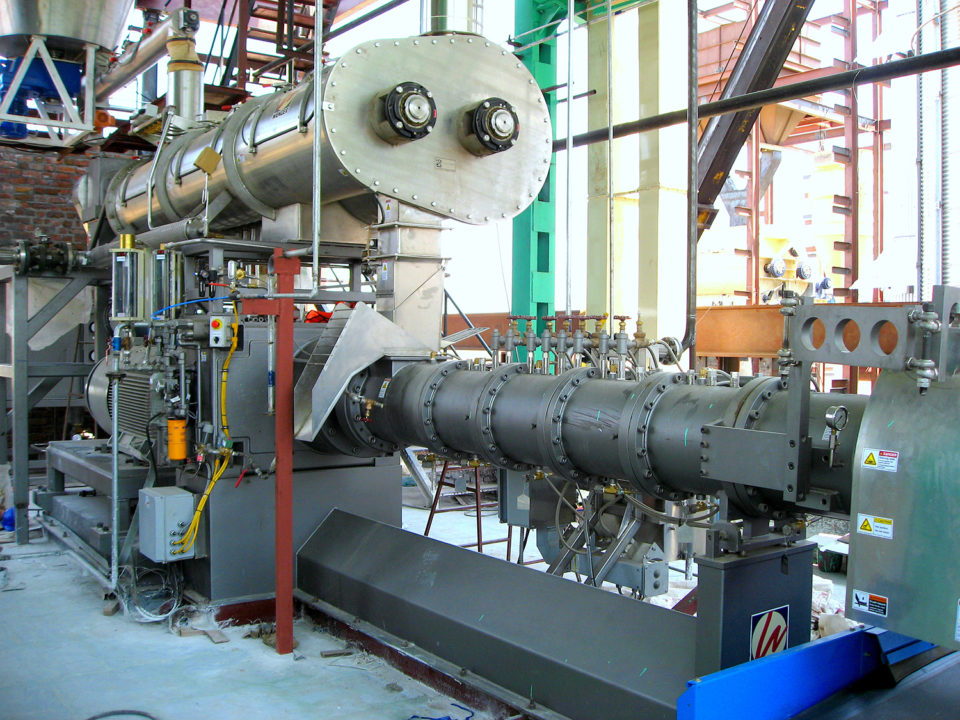

For a long time, India traditionally used only the pond-based fish farming systems and has not strongly considered other options for culture system diversification that could greatly increase fish production. Recently, a few provinces in India have taken up cage farming of freshwater fish. In fact, the limitation for the development of cage culture until 2008 was that extruded floating fish feeds were not available, but this constraint has now been overcome.

In addition to the pond and cage-based systems, India can also adopt many other modern systems that can significantly increase production and at the same time conserve water, land usage, optimize inputs such as feed, power, fuel and other inputs. The in-pond raceway system (IPRS) is currently being tested out in India and the South Asia region by the U.S. Soybean Export Council (USSEC) to evaluate its economic suitability. IRPS merges the biological benefits of a pond-based system and the mechanical water flow benefits of a recirculation system.

Impact of formulated aquafeeds

India did not appear on the list of Asian countries that produced formulated fish feed until 2007-08, and it was in 2008 that the first fish feed plant became functional. The feed-based farming demonstrations conducted by the U.S. Soybean Export Council since 2003 were instrumental in opening some opportunities for fish feed industry. Aligning with the introduction of scientifically formulated, extruded floating fish feeds was the regularization of farming of pangasius (Pangasius hypophthalmus) in India. The growth of pangasius farming was greatly supported with the introduction of extruded feeds, thus adding a new and significant species for the country.

The first extrusion feed mill in India was inaugurated in 2008 and thereafter there were an array of feed mills that were constructed and operated. By the end of 2013, there were 12 feed mills with an installed capacity of 1.55 MMT of feed per annum. About 683,000 metric tons (MT) of extruded fish feed was sold in 2013, indicating a feed mill utilization capacity of 44 percent. By 2018 there were 30 fish feed mills in India with a collective installed capacity of 2 MMT per annum. About 1 MMT of fish feed was sold in 2018, indicating a feed mill utilization capacity of 50 percent.

The demand for extruded formulated fish feed did not increase proportionately with installed feed capacities, and one of the main reasons is a narrow range of feed consuming species that are farmed in India. The country relies largely on carps, which can be fed with various feedstuff combinations other than formulated feed. When the farm gate price of carps is economical to the farmer, they are fed with good, high-priced feeds, and when prices fluctuate and decrease, the fish are fed with low-cost, supplemental feed ingredients. Additionally, the Indian major carps by nature are slow feed consumers. As India mainly farms carps and because Indian major carps are not good feed consumers, the current feed capacities installed are underutilized.

Most of the country’s aquafeed production is used for the farming of pangasius and Pacu (Piaractus brachypomus), which are aggressive feed consumers. Tilapia farming is yet to make a mark in India. Increasing species diversification seems to be key for India to march forwarded not only on feed utilization front but also to increase fish production and address farm gate price stability. This intervention will help offer multiple options for customers and will help produce fish with fewer intermuscular bones, identified as a major customer preference.

Impact of feed-based fish farming

The introduction and popularization of feed-based fish farming in India has resulted in many other advantages. The amount of organic loading that supplemental feed contributed to water bodies in the country has significantly been reduced due to introduction of formulated feeds. If 1 MMT of formulated feed has been used in 2019 for fish farming at an approximate FCR yield of 1.5, it has clearly displaced the traditional fish feeds which operated at 3 to 4 FCR to a kilogram of fish production. In other words, about 2 to 3 MMT of nutritionally poor, agri-based feed supplements have not been applied into ponds since the use of formulated feeds began. India has only 4 percent of worlds water resources and 17 percent of world’s population and thus water conservation is of prime importance. Thus, it is imperative to conclude that the feed-based system has contributed significantly to water conservation which is a subject of national importance.

It is estimated that only 10 to 15 percent of Indian freshwater fish have been brought under feed-based farming, and a great majority of freshwater aquaculture still has scope for converting to this system, which if properly addressed will contribute more to resource savings and at the same time increase fish production in the country.

The feed-based system has clearly led to some recent, small developments in the species diversification efforts. Modern feed mills with good imported equipment can now produce high-protein, high-energy feeds for species like the Asian sea bass or barramundi (Lates calcarifer), snakeheads (largely Channa striatus), pompano (Trachinotus blochii ) and cobia (Rachycentron canadum) and this is seen as encouragement for farming new species.

With about 30 high-tech feed mills currently operating for fish feed production, the sector has generated significant employment opportunities for skilled as well as non-skilled workers. Allied businesses like feed equipment manufacturers (domestic and international firms), feed additive and raw material suppliers and other infrastructure support for this new sector are helping, which is a major change and development for the industry.

Markets

Most freshwater fish are transported to markets in fresh or iced condition. Some, if close to markets, is transported live to help fetch higher prices. There are some large markets – such as in the province of West Bengal – where carps are in demand daily. The endemic population in the province culturally likes eating fish, and farmers and traders make efforts to transport fish to such attractive destinations.

In India, its usually the fish traders who pick up fish at harvest and trade it off for a higher price to different markets. Fish is not generally available throughout the day in markets, its sold either in the mornings or evenings for a limited period, and this limits the reach of fish to customers.

Despite significant consumption of fish by Indian people (12.8 percent of total animal protein sources), the country still falls short on fish protein availability at 5.04 kg per person per year, compared to world consumption at 20.5 kg per person in 2019. A few assessments made in India reveal more factors responsible for low preference for fish protein/fish consumption. Some of these include 1) the presence of intermuscular spines in carps or lack of fish varieties with no intermuscular bones; 2) inefficient marketing and post-harvest handling; 3) lack of adequate value addition and processing; 4) overall food safety and hygiene factors; and 5) lack of knowledge on where and how to buy fish, what to buy and how to cook. If these factors can be addressed from a consumption perspective, the country would gain largely in terms of improving customer preference for fish.

Challenges

India must address some challenges to further develop its fish farming sector, including the following technical challenges:

- The country’s sector is based and operates on a few fish species – carps, pacu and pangasius – and increasing this base will increase fish production.

- Overproduction based on fewer species leads to oversupply of particular varieties of fish and this eventually leads to price drops and variability.

- Lack of other potential aquafeed-consuming species or high-value fish in India, and this should be a consideration for new introductions. For example, tilapia farming is yet to take off in the country.

- Lack of hatchery technology for the introduction of new species, which could include freshwater, brackish and marine species.

- Species diversification will help stabilize prices and increase demand for formulated aquafeeds.

- Freshwater fish farming is still based on traditional methods – large ponds, no water exchange, no draining, and no bottom sediment removal – that often lead to conditions that promote disease.

- Use of modern culture systems that use less land and water will greatly benefit the sector and should be given more importance and prioritized.

- The availability of water and unpredictable monsoons have a direct bearing on the country’s aquaculture production.

And some market challenges include:

- The inferior quality of fish produced in inadequately managed production systems affects customers’ acceptance and preferences.

- The lack of adequate cold chain and distribution systems for fish as a perishable product affects availability and marketing.

- The low farm-gate prices for low-value species does not support their economic performance. India should aim at adopting fish species and marketing systems that generate farm-gate prices of INR 120/140 per kg (U.S. $1.72 to 2.00 per kg) at the lower scale, to INR 250/300 per kg ($3.60 to 4.30 per kg) farm-gate prices for high-value, premium fish. This should include freshwater, brackish as well as marine fish species.

Finally, the higher preference for fish and increased fish demand and consumption in India will create more demand and production, and this is an opportunity for the sector.

Perspectives

India holds the second position in the world for freshwater fish farmed production. There is immense scope for its development when improved systems and species are adopted.

A large extent of Indian aquaculture is still based on traditional farming methods. Converting them to modern farming methods will increase fish production and will also address sustainability of environment.

The marine fish farming segment is hitherto untapped and establishing commercial hatchery technologies and suitable farming methods is yet another significant opportunity, given the country’s vast coastline.

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Author

-

Dr. P.E. Vijay Anand

Deputy Regional Director

U.S Soybean Export Council

Asia Subcontinent[103,114,111,46,99,101,115,115,117,46,116,99,64,100,110,97,110,97,118]

Related Posts

Innovation & Investment

Investing in Africa’s aquaculture future, part 1

What is the future that Africa wants? Views on how to grow aquaculture on the continent vary widely, but no one disputes the notion that food security, food safety, income generation and job creation all stand to benefit.

Health & Welfare

A study of Zoea-2 Syndrome in hatcheries in India, part 1

Indian shrimp hatcheries have experienced larval mortality in the zoea-2 stage, with molt deterioration and resulting in heavy mortality. Authors investigated the problem holistically.

Responsibility

‘Cash-SIS’ culture yields money crop, family food

In a study of pond polyculture, manipulation of species composition improved fish yield and corresponding income. Selling the whole production increased income 27 percent.

Responsibility

Development of inland saline-water aquaculture in Punjab, India

The successful development of aquaculture for shrimp, carp and other species in inland areas waterlogged with saline waters in the State of Punjab, India, shows the potential for this activity in the 1.2 million hectares of these areas in northern India.