Inspiring presentations have industry looking at a bright future, with room for improvement

With the prideful message “So, we are in the right business!” prominently displayed on an enormous video screen behind him, Pearse Lyons dug into his opening keynote address, “The Future of Food: An Aquaculture Opportunity,” at the Global Aquaculture Alliance’s annual GOAL conference, held 4-6 October in Dublin, Ireland.

Lyons, founder of animal nutrition giant Alltech, rattled off a list of current political and demographic challenges before stating the obvious: “We’re working and living in a strange world. What you do now can be around the world, literally in seconds. It’s a world of community, a world of connectivity and a world of shifting populations.”

Aquaculture’s challenge in this strange world – assuming responsibility as a reliable and predictable source of nutrition for a growing global population – would be better accomplished, he seemed to be saying, with a greater sense of confidence. Although Lyons may have been preaching to the choir – the 400-plus attendees who gathered at Dublin’s Croke Park came from all sectors of the aquaculture value chain: producers, suppliers, buyers, merchandisers, academics, government officials and non-governmental organizations – they clearly needed to hear a positive message, as aquaculture’s challenges are many.

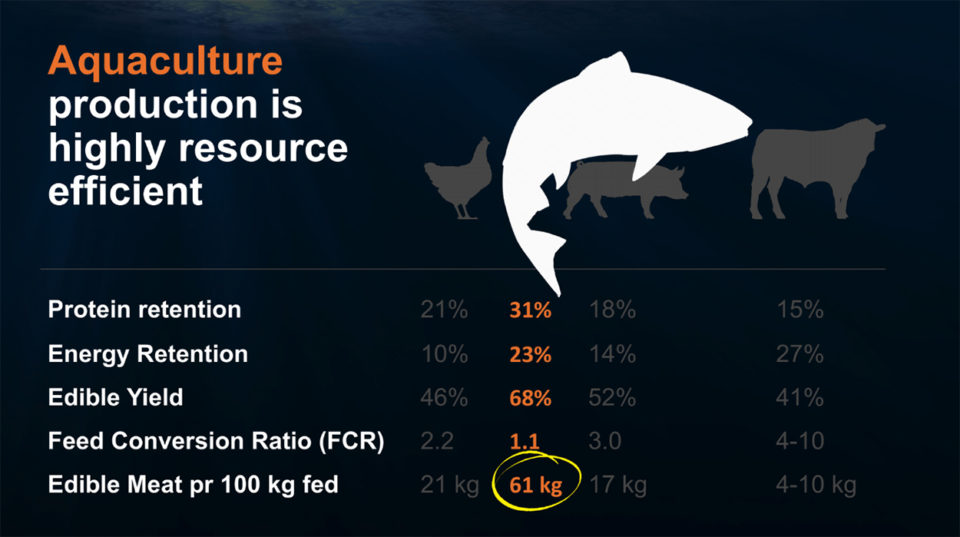

“We have a shortage of resources. Despite all the gloom and doom – and I don’t do gloom and doom – people need to be fed. And if we ask ourselves, ‘How are they going to be fed?’ and ‘What is the best protein to feed them?’ and ‘What is the most efficient protein to feed them?’ and ‘What’s the best use of our resources?’ … we think of protein retention, energy retention and meat per 100 kilos. Poultry, beef: At 21 kilos, it’s not a pretty picture. It’s certainly not a very efficient picture,” said Lyons. “Yet we drop in aquaculture? We get 61 kilos. The most efficient protein converter out there is aquaculture. We are absolutely in the right business.”

Convincing consumers around the world to accept farmed seafood, Lyons pointed out, will require the industry to be more transparent and truthful about their products and processes. Is it Smoked Scottish Salmon, or Scottish Smoked Salmon? There seems to be no difference between the two but the price consumers are asked to pay can be significant.

“[Aquaculture is] growing but, frankly, is it sustainable, in this open world of ours, in this world of constant analysis of what we do, where we do it and how we do it? And there are problems out there,” he said.

Those problems include, but are not limited to:

Animal health and welfare

GAA President and noted shrimp disease expert George Chamberlain analyzed the annual shrimp and finfish production data by telling the stories behind shrimp and finfish aquaculture production highs and lows. Disease, his global network of producers told him, remains the No. 1 challenge.

China’s shrimp farming, for example, is experiencing a difficult period. “The era of easy shrimp farming is gone forever,” shrimp producer Ma Jia Hao of Guangzhou Liyang Bio Tech Co. reported, via Chamberlain.

While environmental deterioration in China requires water-quality remediation, Ma Jia Hao added that future shrimp breeding programs should also change to adapt. While traditional breeding programs have looked at growth rate as the primary factor, “greater resistance to environmental stress” may be a sounder strategy.

Fellow shrimp producer Chen Dan, of Guangdong Evergreen Conglomerate, agreed, saying that shrimp hatcheries need to tighten operational standards to improve larval quality, and that Chinese shrimp breeders are selecting lines that better adapt to local environmental conditions.

Robins McIntosh, senior VP at CP Group in Thailand, did not attend this year’s event but reported that the microsporidian Enterocytozoon hepatopenaei (EHP) has yet to be controlled, with infected material getting out of hatcheries. McIntosh stressed the need for improved diagnostics. He also agreed that growth rate has long been shrimp breeders’ primary focus, but that a shift to hardier animals more adept at surviving in challenging conditions was in order.

“Overall, the growth of shrimp farming is slow,” said Chamberlain. “Ecuador and India continue to expand, but this is tempered by contraction in China. Disruptive technologies are needed to overcome the current bottlenecks.”

Consumer education

Consumers want cheap food, which creates a dilemma between price, quality, uniqueness and, by implication, food safety, said economist Jim Power, who delivered the Day 2 keynote address. Power, a native of Ireland, tailored his talk to reflect challenges for food producers.

“For anybody in the food production business, it’s a challenging environment,” he said. “Population growth [will lead to] a 60 percent increase in agricultural consumption. [Food is] a sector with a good future but in an environment of limited pricing power and more volatile prices, efficiency in production will be key to success.”

The effort in educating consumers about aquaculture seemed like a taller order than ever after Jim Griffin, seafood industry veteran and Johnson & Wales University professor, ran through results of a 2017 survey of UK chefs and found that there was enormous opportunity to educate them about sustainability and what common seafood eco-labels mean.

In the 95 qualified responses, it was clear that their understanding of sustainability was “very mixed,” said Griffin.

Two-thirds of the chefs agreed that sales of seafood were on the rise in the U.K. and that sustainability was very important. However, only 58 percent of the chefs recognized the Best Aquaculture Practices eco-label, and only a small portion of them had the correct answer as to what any of the eco-labels they were shown truly meant.

“Eco-labeling is critically important to what we’re doing, in terms of integrity,” said Griffin, who unfortunately concluded that only one-third of chefs had a positive opinion of farmed seafood. “This is a huge opportunity [to educate].”

Environmental and social responsibility

Independent consultant Birgitte Krogh-Poulsen, a member of GAA’s Standards Oversight Committee, said the drivers of forced labor in seafood supply chains are poverty, discrimination and acceptance of inequality. Many seafood processing and fishing vessel workers face unsafe working conditions and low wages, but they will still say that they’re “better off than with no work,” which only feeds into the issue.

She urged that the industry must treat the problem, not the symptoms. This means creating safe working conditions with gender equality, protections for young workers and community-development efforts.

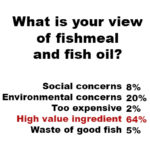

Meanwhile, Libby Woodhatch, head of advocacy for UK seafood association Seafish, said its Responsible Fishing Scheme (RFS) is undergoing pilot tests to see if the program can be implemented in other fisheries. Wild-capture fisheries remain a hot-button issue for aquaculture for its dependency on fishmeal and fish oil for aquafeeds.

Feed sustainability

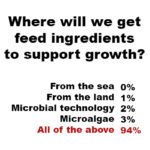

Aquaculture is the world’s largest buyer of fishmeal and fish oil supplies, but novel feed ingredients like microalgae, insect meal and single-cell organisms are proliferating due to the industry’s strong growth projections.

Andrew Mallison, director general of IFFO-The Marine Ingredients Organisation, said fishmeal and fish oil supplies are being buoyed by fish trimmings from processing facilities, a resource that had historically ended up in landfills.

“We’re recovering more byproducts. There are 12 million metric tons of byproducts available. There are logistics to tackle. But 35 percent of the current supply is from byproducts and will go past 50 percent in next five years,” said Mallison during the panel discussion “Aquafeed Sustainability: The Next 20.”

Mallison also sharply criticized the way some characterize the emergence of alternative feed ingredients, saying fishmeal is equally crucial to the future of aquaculture. He said the recent F3 (fish free feed) contest “demonized” the fishmeal industry, when it should be collaborating with all sectors.

“We’re all trying to see the industry go forward, welcoming alternatives, yet the F3 campaign is trying to narrow those choices on dubious claims,” he said.

University of Arizona Professor and F3 organizer Kevin Fitzsimmons, to whom Mallison’s comments were directed, had earlier equated IFFO to “cancer doctors” who had worked to reduce overfishing, illegal fishing and forced labor in the fishing sector. “They’re doing great things,” said Fitzsimmons, “but fighting cancer is expensive. As we get more responsible fisheries, it’s imperative that we find alternatives.”

Josh Silverman, Ph.D., chief product and innovation officer for Calysta, said the biotechnology company based in Menlo Park, Calif., sees itself as providing a sustainable “additive” to aquafeeds. Its innovative FeedKind® protein is produced via non-GMO methanotrophs fed on methane.

“Humans will consume more food in next 30 years than in the entirety of human history until now,” Silverman said, stressing the need for sustainable inputs into aquaculture.

Investment

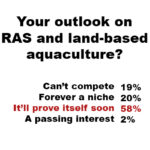

High aquafeed prices and high mortality and biological costs are the two biggest factors impeding aquaculture’s growth trajectory, according to Gorjan Nikolik, senior industry analyst for Rabobank.

“The solution is novel feed ingredients,” he said, referring to algae, insects and single-cell organisms that are gaining steam and attracting investors.

Nikolik was buoyed by what he called a “proliferation of innovation” in the sector. “The last two or three years have been a boom.” He said microalgae has the greatest potential for commercial success, for it has the essential omega-3 fatty acids not found in other alternatives. “The smart money is betting on this technology,” he said.

Nikolik added that fishmeal prices would need to surge roughly 50 percent – from current levels of $1,200 per metric ton to $1,800 – for alternative ingredients to truly grow into a market force. With prices at current levels, the incentive to adopt alternatives isn’t high enough.

Leadership and innovation

Upon receiving the Global Aquaculture Innovation Award, Walt Rakitsky of Corbion (formerly TerraVia) said the company’s journey toward providing the alternative feed ingredient that aquaculture needs started some 25 years ago. He called now-retired inventor and entrepreneur Bill Barkley, a “pioneer” in the field of microalgae and microbial technology, and that all subsequent efforts are simply delivering the processes he developed.

Corbion, through a joint venture with Bungee Oils, is ramping up production of AlgaPrime DHA, a microalgae source of omega-3 fatty acids that are essential for human – and pet – health.

“It’s not just technology. It’s not just process development. It’s the whole value,” said Rakitsky.

Marketplace

Representatives from the world’s leading retail, foodservice and wholesale companies opined on numerous issues, including international trade constraints facing farmed seafood products. When asked about a potential ban impacting India shrimp producers exporting to the European Union, one that would reportedly be due to non-compliance on antibiotics orders, a mainly U.S.-based panel worried about carryover effects.

“The American consumer still has faith in the [Food and Drug Administration]. As long as we can say there are third-party audits, I don’t think it’ll be a big barrier to the U.S.,” said Steve Disko, seafood category manager at Schnucks, a U.S. supermarket company.

“I might beg to differ,” countered Bob Yudovin, seafood buyer at Harvest Meat Co., adding that he’s already seeing an uptick in import inspections and prices of pangasius from Vietnam, which is the subject of a long-running trade dispute with American catfish growers. Import inspection authority for pangasius has been passed from FDA to the U.S. Department of Agriculture through a contentious process that’s taken many twists and turns over the past decade.

“If FDA aligns with EU, it could follow the EU and then we’d have a serious problem. Not excited to see a knee-jerk reaction,” said Yudovin. “What worries me in the back of my head is, what is the next species that we import the government puts under USDA inspection?”

Eric Buckner, senior director of seafood for foodservice distributor Sysco, said farmed seafood products that meet trade barriers, like pangasius from Vietnam, will “continue to find markets where it gets best value.”

Derrick Guss, seafood and beverages category manager at the Walt Disney Company, summed up the current global seafood trade situation as “a mess” and “a hardship,” but added that food safety is the top priority for any government. Sustainability certification, he added, comes after.

“We’re not getting the credit we probably should. We’re trying to get in front of it. The industry is changing really fast,” he said.

Author

-

James Wright

Editorial Manager

Global Aquaculture Alliance

Portsmouth, NH, USA[103,114,111,46,101,99,110,97,105,108,108,97,101,114,117,116,108,117,99,97,117,113,97,64,116,104,103,105,114,119,46,115,101,109,97,106]

Tagged With

Related Posts

Health & Welfare

Chem-free fixes emerging in sea lice saga

Salmon farmers, using emerging technologies, are exploring new methods of sea lice mitigation in an effort to overcome one of the industry’s most persistent problems. New chemical-free innovations show an industry eager to adapt and adopt environmentally safe practices.

Health & Welfare

Born in Hawaii, SPF broodstock shrimp industry faces globalization

The next step for shrimp breeding will be developing animals that aren’t just disease-free, but increasingly resistant to multiple pathogens. The industry is globalizing, with suppliers setting up shop overseas. But its birthplace will always be Hawaii.

Innovation & Investment

Investing in Africa’s aquaculture future, part 1

What is the future that Africa wants? Views on how to grow aquaculture on the continent vary widely, but no one disputes the notion that food security, food safety, income generation and job creation all stand to benefit.

Innovation & Investment

20 years of the Global Aquaculture Alliance

A timeline of key milestones and achievements by the Global Aquaculture Alliance and its third-party aquaculture certification scheme, Best Aquaculture Practices (BAP).