Bar codes, RFID systems quickly transfer data

Traceability of food products, including those from aquaculture, is a reality. Legal and market requirements for traceability have increased over the past few years and continue to rise.

Examples of national legal requirements include the implementation of the new “E.U. food law” (E.U. 178/2002) and Section 306 of the U.S. Bioterrorism Act in 2005. Both require that all links in the food and feed supply chain have “one step forward – one step backward” traceability, keeping “trace and track” records of their immediate suppliers and customers. Canada, Australia, Japan, and other countries are currently working on similar regulations.

The global food market has also called for increased traceability in addition to implementation of radio frequency identification (RFID) on shipped products. This is especially true for larger retailers like Wal-Mart, Albertsons, and Target in the United States; Tesco and Marks & Spencer in the United Kingdom; Carrefour in France; and Metro in Germany; which are at the forefront of this development.

Seafood sourcing

Earlier this year, Wal-Mart committed to label all its wild-caught seafood products with a Maritime Stewardship Council (MSC) logo and farm-raised shrimp with a Best Aquaculture Practices (BAP) logo over the next three to five years. The MSC logo indicates the fish was harvested from sustainable stock. The BAP logo indicates the shrimp were raised using practices that meet the BAP standards developed by the Global Aquaculture Alliance and administered by Aquaculture Certification Council, Inc. These label programs call for increased traceability.

Restaurants have also begun offering seafood selections that customers can order by origin from the menu listings. Sample platters with, for instance, oysters from different places in the world, have likewise emerged.

Supermarket scenario

In the near future, a consumer buying, for example, a bag of frozen portion-sized salmon at a supermarket will be able to walk to an in-store scanner, scan the bar code or RFID tag, and retrieve all the information about the contents of the bag that he or she wants. This information could include where the fish was raised, when it was harvested, and what kind of feed it received. Where and when it was processed would be reported, as well as a temperature profile of the product from the time it was harvested to the present.

The consumer will also be able to log on to a Web site, enter the identification number of the bag, and retrieve all relevant information. Or she or he can scan the bar code or RFID tag directly into a mobile phone to quickly obtain the information.

Relevance of traceability

Does the average consumer need and want this information? The short answer at the moment is “No.” Most consumers most likely don’t care about all the data, as long as they feel they are dealing with good products. They will now, however, have the opportunity of choice.

On the other hand, restaurants, retailers, fishmongers, seafood processors, and other outlets could use the traceability information to guide procurement. If fish was not good or exceptionally good, the buyers have the possibility to purchase or avoid fish in the future from a particular farmer, raised in a particular pond, or fed a particular feed.

Internal, external systems

Fish farmers who do not already have traceability systems in place should consider several points before making future investments.

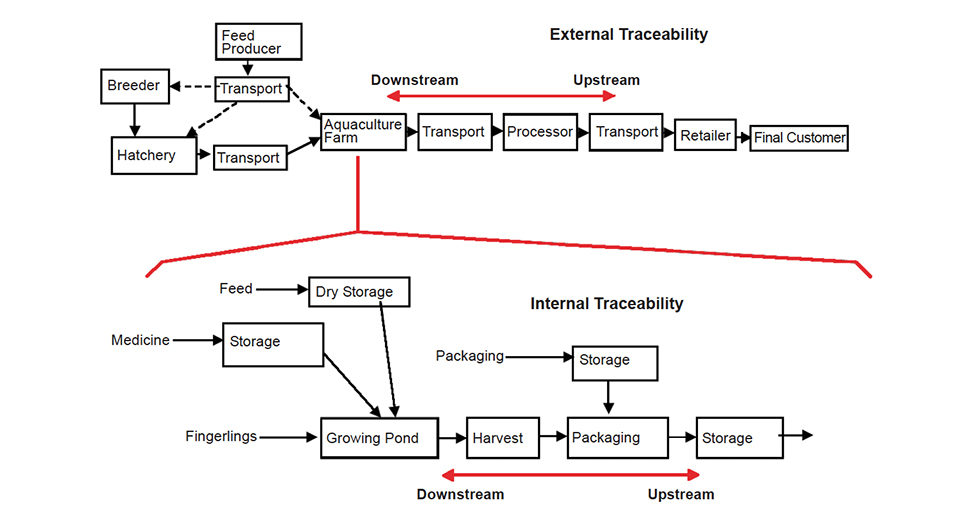

Internal traceability systems (Fig. 1) have been around for a long time in the food supply chain. These systems can be anything from paper-based records kept in ring binders at the office to advanced computer systems that provide information in a few key strokes. Internal traceability systems help food manufacturers or fish farmers track what came into their companies and how it was transformed before it left.

External traceability systems (Fig. 1) require some cooperation and development of standards among the links in the food supply chain. What must be registered? How should this information be kept and distributed in the supply chain? These are questions that are now being debated in the industry. Several traceability systems and standards already exist on the market.

Batch size

One essential element is to determine how small a batch buyers should be able to trace. Should the system trace back to individual fish, fish from one “harvest,” fish grown in one pond per raceway per tank, or maybe fish harvested during one year at the same fish farm?

Answering this question involves what is practical at each farm and the potential return on investment (ROI). While determining the ROI, a risk analysis should be made on what it costs to recall a given batch from the market versus what can be saved by having larger batches. To define individual fish as one unique batch is expensive and can only be justified for a low-volume, high-price species like tuna. On the other hand, if the batch is too large, a substantial amount of fish must be recalled from the market if there is a food safety incident.

Data transfer

Choosing identifiers, carriers, and readers to transfer product data depends on what is most practical under the given circumstances. Identifiers refer to the code systems or “languages” used in the supply chain to register data. Carriers are the physical product tags that carry the code. Readers are the devices used to retrieve the coded data from the carriers. They can be divided into categories of hand-held or stationary readers, and bar code or RFID readers.

Several identifiers are used in today’s food industry, but the most widespread and generally recognized are GS1 for bar codes (formerly UCC and EAN) and EPCGlobal for RFID. Regarding carriers and readers, there are myriads of producers and vendors, so effort in choosing the ones that meet requirements and budgets is important.

Bar codes vs. RFID technology

Bar code technology has been widely used since the 1970s. RFID, also an older technology, is becoming more widespread in the food industry. RFID has become a cheaper technology, with today’s tags today running as low as U.S. $0.05 apiece. Bar codes, however, cost fractions of a cent.

RFID technology uses tags that transmit their code by radio waves and do not have to be in the line of sight of a scanner. In addition to allowing a whole pallet of goods to be “scanned” at once, RFID’s other advantages include holding more information per tag than bar codes, and the ability to withstand harsher, moister environments than regular bar codes (Table 1).

Petersen, Pros and cons of bar codes, Table 1

| Bar Codes | RFID |

|---|

Bar Codes | RFID | |

|---|---|---|

| Pro | Low price | Efficiency |

| Pro | 100% read rate | Withstands harsher environments |

| Con | Require scanner line of sight | Higher price |

| Con | Typical paper material has limited durability | Not 100% read rate |

As mentioned earlier, several initiatives by large retailers demand that suppliers ship their products with RFID tags. It is only a matter of time, perhaps five to 10 years, before RFID tags will become as widely used as bar codes are today.

Hardware, software solutions

Several hardware and software solutions exist for the implementation of traceability. Some companies specialize in hardware or software only, while others are integrated suppliers that provide both. Some companies specialize in general food traceability, while others specialize in segments of the food business like aquacultured products.

When determining what software/hardware to use, look for ROI. How are needs met compared to the price? Look for standards, but since no single standard dominates at the moment, especially in RFID technology, be careful about which standard you commit to in order to make a wise investment.

(Editor’s Note: This article was originally published in the July/August 2006 print edition of the Global Aquaculture Advocate.)

Now that you've finished reading the article ...

… we hope you’ll consider supporting our mission to document the evolution of the global aquaculture industry and share our vast network of contributors’ expansive knowledge every week.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year. GSA individual and corporate members receive complimentary access to a series of GOAL virtual events beginning in April. Join now.

Not a GSA member? Join us.

Authors

-

Arni Petersen, M.S.

North Carolina State University

Department of Food Science Seafood Laboratory

Center for Marine Sciences and Technology

303 College Circle

Morehead City, North Carolina 28557 USA -

David Green, Ph.D.

North Carolina State University

Department of Food Science Seafood Laboratory

Center for Marine Sciences and Technology

303 College Circle

Morehead City, North Carolina 28557 USA

Tagged With

Related Posts

Responsibility

App aims to bring clarity to seafood traceability, social compliance data

For small-scale aquaculture farmers in far-flung regions, creating traceability data can present major challenges, both linguistic and technological. It’s those challenges that VerifiK8 is poised and ready to help solve.

Responsibility

A helping hand to lend: UK aquaculture seeks to broaden its horizons

Aquaculture is an essential contributor to the world food security challenge, and every stakeholder has a role to play in the sector’s evolution, delegates were told at the recent Aquaculture’s Global Outlook: Embracing Internationality seminar in Edinburgh, Scotland.

Innovation & Investment

AI platform delivers data to fish and shrimp farmers

XpertSea does more than count fish. It uses AI and computer vision to calculate growth rates and optimal harvest dates to improve aquaculture efficiency.

Responsibility

Addressing safety in Latin America’s tilapia supply chain

Over the last decade, the experience gained by many tilapia farmers combined with proficient programs implemented by local governments have significantly improved tilapia production in various Latin American countries like Colombia, Mexico, Ecuador and other important tilapia producers in the region.