Survey ranks salmon second to chicken

Our understanding of the opportunities and barriers facing farmed seafood products depends on understanding their positioning among consumers. “Positioning” in this context refers to how consumers perceive a product in relation to competing products. In the case of salmon, as with many other products found in today’s marketplace, product quality is judged based on multidimensional characteristics, such as taste, convenience, availability, healthiness and price-quality relationship or value. As such, the perceptions formed within consumers’ minds are also multidimensional.

These perceptions, as well as the importance consumers assign for each quality dimension, influence consumers’ willingness to consider salmon as a viable alternative to other competing products and, ultimately, their purchase decisions. Perceptions can be formed based on consumers’ own experiences or more indirectly, for example, through word of mouth and advertisement.

In a study funded by the Norwegian Seafood Research Fund, the authors analyzed the position of salmon relative to competing proteins from agriculture among European consumers based on a multinational survey recently conducted in the United Kingdom, Russia, France, Germany and Sweden. To support the growth of farmed salmon production, further penetration into the major protein market is crucial.

Food-related lifestyle

Consumers assign different importance to different quality attributes in forming attitudes about food. To illustrate, take “healthiness” as an example. If a consumer perceives salmon to be healthier than meat from agriculture, this does not necessarily contribute to higher consumption of salmon. A “healthy” perception will only have a positive effect on consumption if consumers are sufficiently concerned about eating healthy food. If they don’t care about healthiness, they will not buy more salmon because it’s healthier than terrestrial meat.

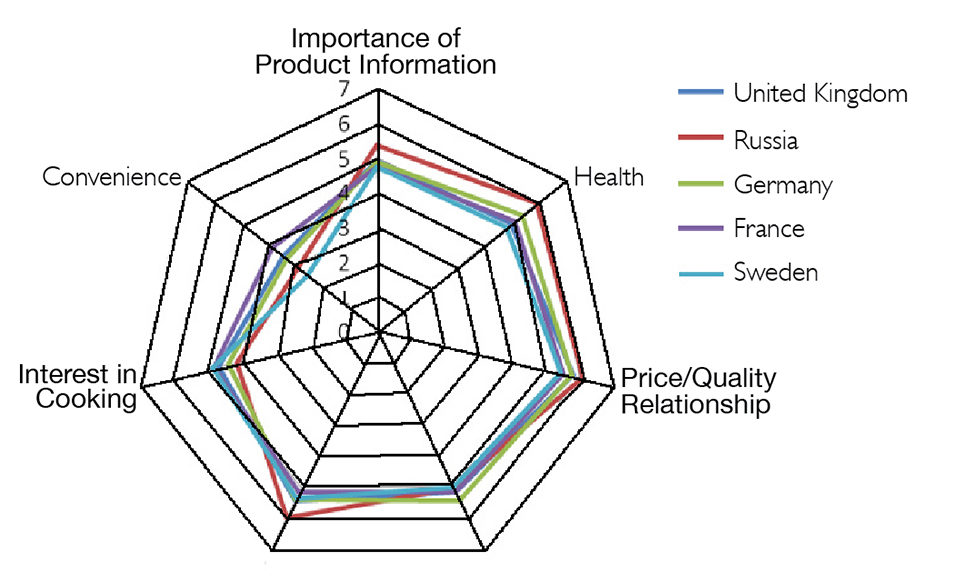

The study employed the food-related lifestyles questionnaire developed by K. Brunsø, K. G. Grünert and others, which has been validated in several international studies. Fig. 1 shows the attitudes to different dimensions of food consumption and preparation reported among approximately 500 consumers in the study. The scale has a range from 1 to 7, where 1 represents the lowest score and 7 the highest importance.

The figure shows that the price/quality relationship – one of the most important aspects – was consistent among countries. Freshness, taste and health also had relatively high importance. Convenience was of less importance and varied across countries.

Salmon vs. meat

There are some challenges associated with the concept of “positioning” in the context of salmon products. The concept is primarily applied to products with strong brand association, such as soft drinks, beer, cell phones and cars. Salmon, on the other hand, is traditionally regarded as more of a commodity than a branded product.

Although various private company brands and private labels exist for salmon, they have not developed sufficiently to form distinct positions in consumers’ minds. Consequently, “generic” salmon was compared with generic agricultural competitors.

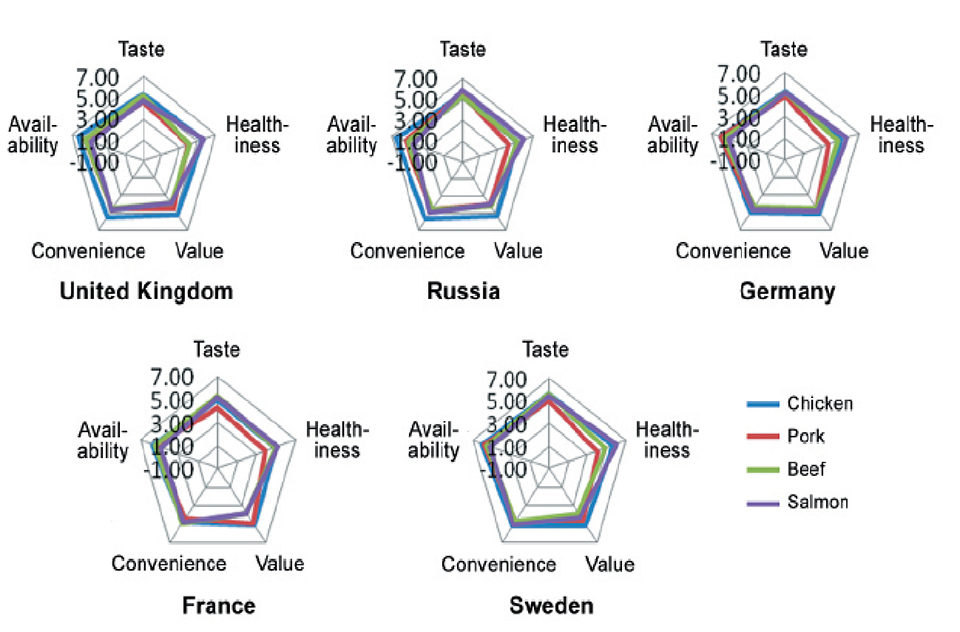

Figure 2 shows the perceptions of 500 consumers from five countries on salmon and other meat categories in five dimensions: taste, healthiness, value, convenience and availability. The consumers rated salmon, chicken, pork and beef on a scale from 1 to 7, with 1 the lowest and 7 the highest rating. The average scores are shown in Figure 2.

For an individual product category, a stronger position is indicated when the curve is closer to the outer boundary of the figure. In all five countries, chicken had the strongest overall position, while salmon tended to have the second-strongest position, ahead of pork and beef.

Strong on health, weak on availability

Salmon scored high in all countries in the health dimension. Chicken came in second, often not far behind salmon. Pork and beef had a weaker position among consumers in this dimension.

Salmon also had a relatively high score for taste, with an exception for the U.K. In Russia, salmon actually scored highest, but in general, chicken and beef had a stronger position for this dimension than salmon in the five countries.

Somewhat surprisingly, salmon scored relatively high on convenience. It had a clearly weaker position than chicken, but was ahead of pork and beef. Over time, salmon development has led to a more differentiated supply of salmon products to satisfy the needs for convenience among different consumer segments and meal situations. Salmon may also have benefited if consumers unconsciously compared it to other fish species.

Salmon ranked last in terms of availability in all five countries. Chicken, on the other hand, had the highest score on availability. This indicated that salmon is perceived to be less available when consumers want it.

Salmon also had a much weaker position in terms of value. Chicken was perceived as the best in this aspect, while salmon ranked last together with beef. The cost of salmon products is still perceived as high compared to meat from agriculture, which may indicate the satisfaction level for the total salmon experience (combining taste, health and convenience) is considered lower than that for alternatives from agriculture.

This may also contribute to the low score on availability. Salmon is not necessarily absent from market shelves, but may not be available for the price consumers are willing to pay and hence perceived as not available and of less value. Luckily, it is possible for salmon supply chains to influence salmon’s perceived value through different pricing, product development, distribution channels and information to consumers.

Consumption frequencies

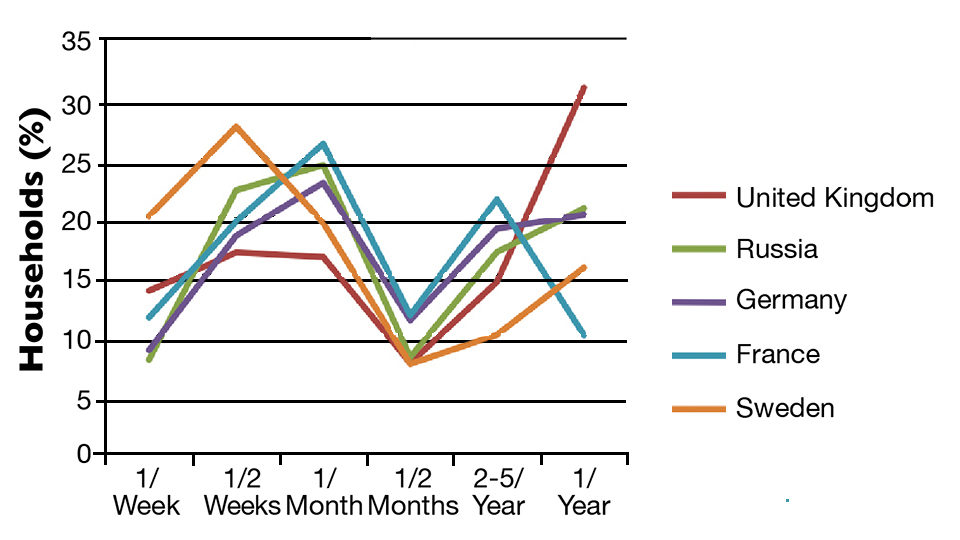

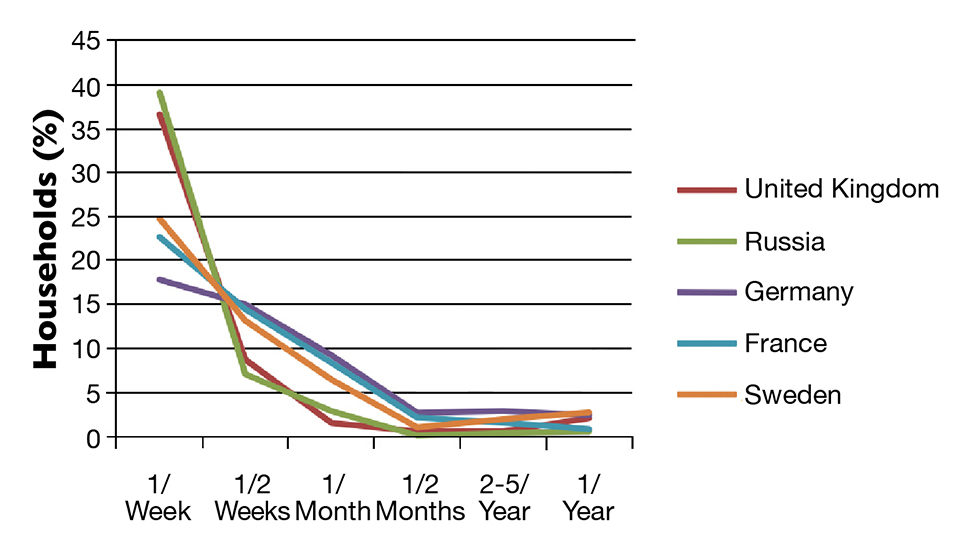

Given its much stronger position than salmon among consumers in all countries, chicken would be consumed more than salmon. In the five surveyed countries, 56 percent of consumers ate chicken at least once a week at home, while only 12 percent of consumers ate salmon at least once a week (Figures 3 and 4). Furthermore, 80 percent of consumers ate chicken at home at least every two weeks, while for salmon, this was the case for 33 percent of consumers. Each month, 91 percent of the consumers said they ate chicken at home at least once, while for salmon 64 percent did so.

Interestingly, there was a significant variation in consumption frequencies across countries. In Sweden, 20 percent of consumers ate salmon at least once a week, and 48 percent ate salmon at least once in two weeks. In Russia, on the other hand, only 8 percent of consumers ate salmon at least once a week, and 30 percent ate salmon once or more in two weeks. In Germany, the percentages were smaller than in the other countries for consumers who ate both salmon and chicken at home.

Perspectives

Responses from the survey showed that opinions from countries differed in the relative importance of various factors related to food. However, the relative ratings of quality dimensions for salmon compared to other meat categories showed some common patterns. Specifically, salmon was regarded as superior in healthiness than other meat. It was also generally considered to have good taste and to be convenient.

On the other hand, all countries assigned low scores for two factors: availability and value, showing that, on average, consumers perceived salmon as less available and a lesser value compared to other meat categories. There was also quite a discrepancy in salmon-eating frequencies among countries, possibly reflecting both cultural backgrounds and market conditions.

(Editor’s Note: This article was originally published in the September/October 2012 print edition of the Global Aquaculture Advocate.)

Authors

-

Asst. Prof. Yuko Onozaka

University of Stavanger

4036 Stavanger, Norway -

Prof. Håvard Hansen

University of Stavanger

4036 Stavanger, Norway -

Related Posts

Health & Welfare

Animal health giants have sea lice in their crosshairs

Alltech and Benchmark have been working on the next generation of sea lice solutions and believe they have new products that can help salmon farmers win.

Innovation & Investment

AquaBounty, with new RAS facility, hopes to win public support for GM salmon

Ron Stotish, CEO of AquaBounty Technologies, believes genetically modified salmon is no threat to its opponents and the outlook for AquAdvantage is good. With its purchase of the Bell Fish Co. RAS facility, commercialization will soon commence.

Innovation & Investment

Aquaculture America 2017: Communication key to the future

This year’s Aquaculture America in San Antonio, Texas, provided significant learning and networking opportunities. It successfully brought together 14 U.S. aquaculture organizations and more than 1,600 participants from Europe, Asia, Africa and Australia.

Innovation & Investment

Aquaculture Exchange: Barry Costa-Pierce, UNE

University of New England Professor Barry Costa-Pierce says aquaculture is often neglected in studies examining ocean health and ecosystem and resource management. The “Ocean Prosperity Roadmap” released this summer, he said, was more of the same.